3 simple reasons why one short-seller is feeling bullish about the rest of the year

Published: Nov 1, 2018 9:37 a.m. ET

By Shawn Langlois

Social Media Editor

MarketWatch

One bear is feeling Bullish

Brad Lamensdorf, manager of the AdvisorShares Ranger Equity Bear ETF HDGE, -1.21% is feeling rather bullish on stocks as we head into 2019.

Come again?

Obviously, this is not the kind of take you’d typically expect from a guy whose job it is to bet against the stock market. After all, Lamensdorf said earlier this year that “the pain is coming and is unavoidable.”

But, after the October carnage, he’s singing a very different tune. Now, three short-term indicators are telling him that investors “could experience profitable upward bounces during the rest of 2018.”

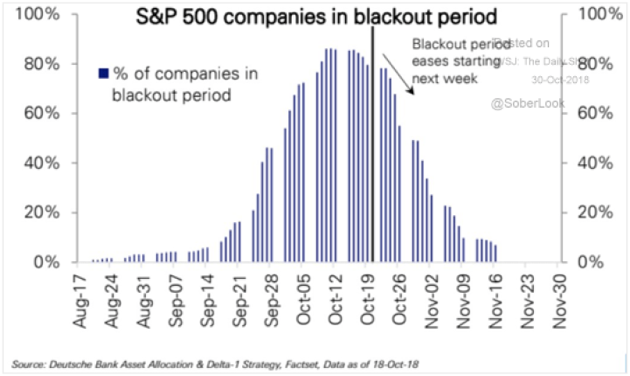

First, companies can once again buy back their shares after emerging from blackout periods, which should lend some downside protection if volatility VIX, -3.58% continues to roil markets. “Indeed, the fact they couldn’t buy during September and October may have exacerbated the recent sharp market declines,” Lamensdorf said.

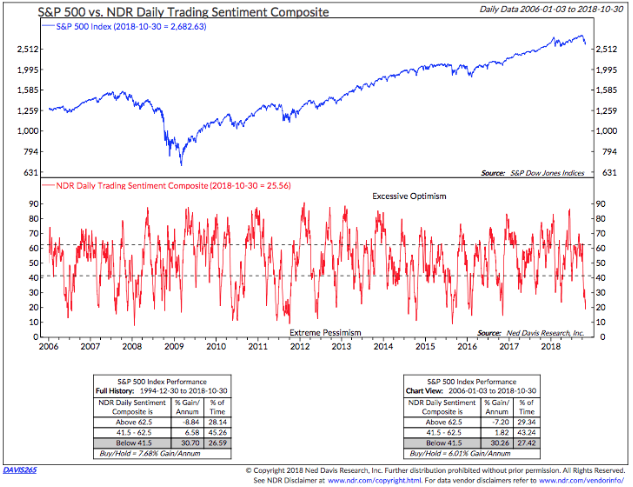

Also, Lamensdorf pointed out that the Ned Davis short-term sentiment indicator is at only 20% bullish, the lowest level of the year. “That means there’s a huge amount of bearish sentiment out there,” he explained. “And that’s positive news from a contrarian point of view since historically investors are wrong about market direction.”

Lastly, Lamensdorf said funds are finished with the tax selling that’s recently weighed on markets. “That adds even more liquidity for upward market momentum this year as these investment companies initiate buying programs to maximize annual returns after flat to downward performance for the first 10 months of the year,” he said.

So far so good with that prediction. The Dow Jones Industrial Average DJIA, +0.46% rose 241 points on Wednesday and continued to move higher on Thursday. The Nasdaq Composite COMP, +0.29% also built on its 2% rally from the prior session.

This article was originally published on the MarketWatch blog. https://www.marketwatch.com/story/3-simple-reasons-why-one-bear-is-feeling-bullish-about-the-rest-of-the-year-2018-10-31?fbclid=IwAR2-Lr7DEXelIRpleY6OGZtXmTd9HifNoPBzXaaoO2UGKEZt0JcIhLMxq64