A Chink in the Rally Armor

By John Del Vecchio and Brad Lamensdorf

Market sentiment remains very bullish. Too bullish. The weekly bulls and bears poll conducted by Market Intelligence shows 63.6% bulls and 17.2% bears. That’s only a slight change in bulls from the week before when they hit 64.4%.

Too many bulls by itself isn’t a contrary indicator. Yes, those folks are leaning the wrong way. But, what goes up can go up even more before the tide turns.

One chink in the armor suggests the tide might be turning.

Market breadth.

Until now, the breadth of the market has been strong in this rally. That changed a bit on Wednesday. The S&P 500 Index made a new 52-week high (no news there), but there were 75 more declining issues than advancing issues in the index for the day.

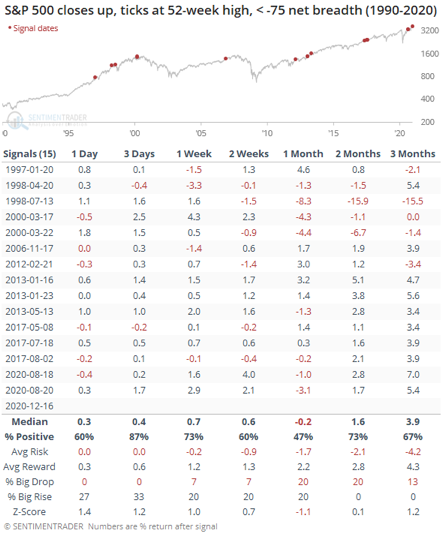

Here are some stats courtesy of SentimenTrader when this condition has occurred in the past.

When this situation occurs, returns are historically negative one month out. About 53% of the time, the market suffers a loss. Three months later, there’s typically an excellent recovery. On average, the market is 3.9% higher. However, there have been some significant declines, such as the 15.5% loss in July 1998.

One day does not make a trend. However, it is a warning sign. It’s a sign to be on guard. With so many investors leaning in the bullish direction, now is the time to be paying close attention. It’s not a time to be complacent.

The Active Alts SentimenTrader Long / Short strategy is anything but complacent. The strategy utilizes decades of real-world experience and research with a sharp focus on risk management. Give Brad a call to learn more about how you can be better positioned in your portfolio in 2012 and beyond.