Active Alts Focused Momentum +79.60% in 2020

By John Del Vecchio and Brad Lamensdorf

2020 was an exceptional year for expensive stocks!

A fascinating research piece produced by GMO (managers of $60 billion +) highlighted that in 2020, value stocks returned their worst 12-month performance in history. What’s more, the spread between value stocks and the market is at a historical gap.

The pain for value investors does not stop there. It has been a terrible 14-year run for value stocks. It’s the worst period ever.

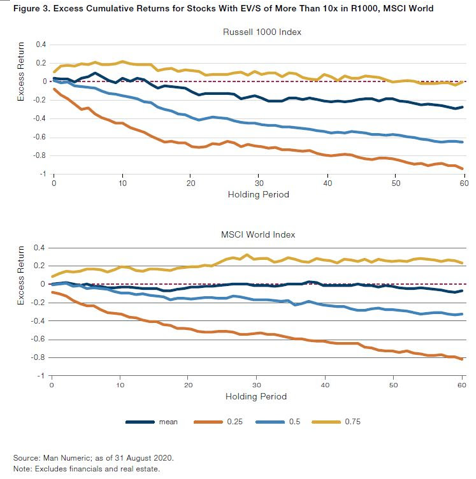

Interestingly, a report produced by Man shows that stocks with nosebleed valuations still lag the market over time. By a lot.

Here’s the chart:

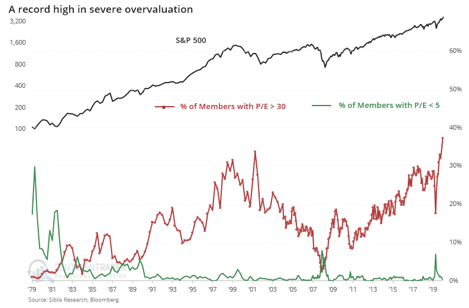

As Man points out, the biggest companies in the S&P 500 are trading at near historically expensive levels. Can those valuations be justified?

Possibly in a few cases. But not for most.

The median stock among the high rent district of over-priced shares under-performs the market by 65% over five years. Due to some big winners, the average performance is 28% over the same 60 months.

If you’re not in the right big winners, then you risk falling behind severely.

However, value is just one factor to consider.

Limiting oneself to one factor seems somewhat, well, limiting.

If value falters in a given year, then there goes your year. Meanwhile, other strategies perform just fine, indeed.

There were plenty of other factors to be used, in conjunction with value, to boost returns in 2020.

We believe this will continue to be the case in future years.

At Active Alts, we consider value, but also earnings quality and momentum, among other factors. An asset can be cheap but in a death spiral toward implosion. The use of other factors helps filter this out.

One is momentum. Strong buying power in positive trends reinforces the move higher. While value can be a death trap, the trend can be your friend.

There were plenty of quality stocks priced right in positive trends in 2020. Not only that, the risk/reward ratios were fantastic.

That is Active Alt’s wheelhouse.

Based on decades of experience, these situations present themselves in virtually any market environment.

Active Alts operates two strategies to navigate through all market conditions.

The long-only, Active Alts Focused Momentum Strategy was up 79.60% in 2020. What’s more, 2020’s performance was achieved with an average exposure of 74.87%.

In the fourth quarter, the strategy turned in a performance of 22.16%, with an average exposure of 55.09%.

Quality, momentum, value, and risk/reward. Those are the factors, when combined into one cohesive approach, are the engine that powers the Active Alts Focused Momentum Strategy.

The Active Alts Long / Short finished 2020 up 25.91%

That same GMO report, published December 8, 2020, is decidedly bullish on the long /short space in the future. The historical spread between value and the market is likely to revert to the mean.

This bodes well for tactical stock pickers.

Want to know more about the Active Alts Focused Momentum Strategy and the Active Alts SentmenTrader Long / Short Strategy?

Please schedule a phone call with Brad today.