AIM Higher

By Brad Lamensdorf and John Del Vecchio

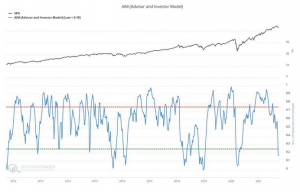

SentimenTrader.com’s AIM model (Advisor and Investor Model) suggests a short-term bounce is in order.

A quick eyeball test will tell you that when the indicator is below the green line, the market is ripe for a healthy bounce. Recently, the indicator collapsed sharply from overbought to oversold. As a result, we think being aware of this situation is even more important than at other points in history.

Here’s some detail on the construction of the model.

Construction:

The Advisor & Investor Model (AIM) is a model consisting of sentiment readings from several popular (and some not-so-popular) advisor and investor surveys. The index is computed on a weekly basis.

This model takes advantage of the fact that when the typical investor and investment advisor should be most bullish, they are most bearish. And, when the markets are getting overbought and are about to turn, these Johnny-come-lately are most bullish.

When a preponderance of the survey respondents are more bullish than they’ve been in the recent past, then the model will move towards its upper (red) trading band. When it approaches this band (or exceeds it), then we should be concerned that too many investors are expecting higher prices, have likely already bought, and therefore support for further prices gains is minimal.

Alternatively, when the model has moved towards or outside of its lower (green) trading band, then we know that investors have soured on the market’s prospects to an extreme degree. This rarely lasts long, as the market has a strong tendency to rebound after such episodes. These signals are especially strong when the market tone is positive (e.g. the 40-week moving average of a broad index like the S&P 500 is rising).

To learn more about how these indicators can help manage risk in your portfolio, book a call with Brad.

DISCLOSURE: LAMENSDORF MARKET TIMING REPORT

Lamensdorf Market Timing Report is a publication intended to give analytical research to the investment community. Lamensdorf Market Timing Report is not rendering investment advice based on investment portfolios and is not registered as an investment advisor in any jurisdiction. Information included in this report is derived from many sources believed to be reliable but no representation is made that it is accurate or complete, or that errors, if discovered, will be corrected. The authors of this report have not audited the financial statements of the companies discussed and do not represent that they are serving as independent public accountants with respect to them. They have not audited the statements and therefore do not express an opinion on them. The authors have also not conducted a thorough review of the financial statements as defined by standards established by the AICPA.

This report is not intended, and shall not constitute, and nothing herein should be construed as, an offer to sell or a solicitation of an offer to buy any securities referred to in this report, or a “buy” or “sell” recommendation. Rather, this research is intended to identify issues portfolio managers should be aware of for them to assess their own opinion of positive or negative potential. The LMTR newsletter is NOT affiliated with any ETF’s. Active Alts is affiliated with Lamensdorf Market Timing Report. While LMTR uses charts from SentimenTrader, they do not have a financial arrangement with SentimenTrader Past performance is not indicative of future results.