Buffet is in the Nosebleed Section

By John Del Vecchio and Brad Lamensdorf

He’s back!

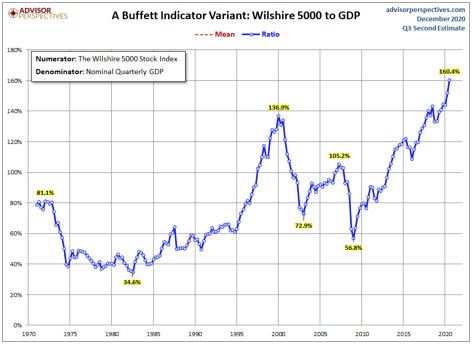

This week we again highlight Warren Buffet’s favorite indicator.

Courtesy of Advisor Perspectives, the ratio of the Wilshire 5000 to nominal quarterly GDP continues to break out to new levels.

Check it out:

The ratio is not just breaking out to new highs. It’s in nosebleed territory. It’s a generational level of market valuation.

It looks like a runaway train.

Can it sustain itself?

Possibly. However, the markets are clearly distorted these days. The ultimate impact of ultra-low interest rates, for example, may not be known for years to come.

We do know what happened the last two times valuations veered too far from the norms. Back in 2000, the ratio was about 137%. By 2007, the Housing Bubble pushed it to 105%. Not as frothy, but still outside the bounds of what might be considered “normal.”

Both instances ended badly. It was a horror movie with plenty of blood spilled.

We have been in uncharted territory now for several years.

While there has been a fundamental change in the valuation of the markets, we know there is one thing that does not change.

Human nature.

We know from market sentiment that too many people are leaning in one direction.

That direction is long.

We know that they are leaning in that direction more and more with leverage.

We know that increased leverage comes at a time when market valuations sit in rarified air.

What we don’t know is what could cause everything to swing the other way. However, we do not need to predict that. Too many people are too wrong too often for the market just to climb unabated.

Right now, there’s an “air pocket” that exists under stock prices. It’s a matter of when, not if, that air pocket is popped and all of these indicators swing back the other way. From here, gains will likely be reversed.

As we have pointed out several times in this historical rally, there have been numerous times to aggressively buy stocks tactically and with low risk.

Right now, we are far from making that call again.

Tread lightly.

The Active Alts SentimenTrader Long/Short Strategy uses this indicator. Learn more about how this indicator can guide your investments in these uncertain times, schedule a call with Brad Lamensdorf who manages this strategy, here.