Bullishness Reaches Extreme Levels

By John Del Vecchio and Brad Lamensdorf

As Alexander Hamilton once said, “the masses are asses.” He probably wasn’t referring to the collective wisdom of investors, but it could easily apply to this group.

As a group, investors are terrible at projecting forward market returns.

When investors are leaning too far bullish or bearish, it creates great risk / reward opportunities.

We love extremes.

Right now, we are at an extreme in bullishness.

Newsletter sentiment is currently 60% bullish and 19% bearish. We are projecting that the bullish number could tick up another 2-3% next week as the 60% level was hit before the vaccine announcement earlier this week.

These levels are rare.

A bullish level above 60% happens about 6.4% of the time going back 50 years. A spread of 40% happens 8.8% of the time. A combination of the two? Just 3.8%.

As we all know, we are not in normal times. It’s certainly not normal in terms of market sentiment.

When this situation occurs, market returns are just 0.4% three months out. Of course, that doesn’t mean they are flat. It could mean a major ass kicking and then as sentiment normalizes a market bounce occurs to claw back to even.

Sentiment could be right this time. But, probably not. Markets change. Human nature stays the same.

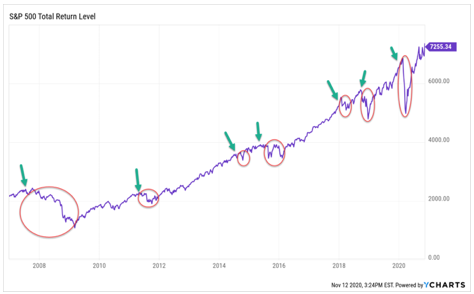

Looking back at recent history over the last 15 years, every major correction has been preceded by this big spread in bullish / bearish sentiment.

Conclusion?

Hamilton was right. The masses are asses.

It’s also important to note that the average investor is overly bullish too. We do not put as much weight into this indicator as we do newsletter writers. But we are also well outside the norm.

Here’s some quick stats on where we are.

Bulls are 56%. That’s in the top decile of the last 33 years. It’s in the top 6 since the March, 2009 low. We should point out that March, 2009 was the most bearish period ever. Right before a huge bull market run.

The bull to bear spread is 31%. That’s in the top give in history.

Both of these levels are the highest since January 2018.

Want to know more about how sentiment can impact your portfolio?

Why don’t you give Brad a call? Brad’s Active Alts SentimenTrader Long/Short Strategy combines several decades of experience and research and actively positions the portfolio to take maximum advantage of market extremes. In both directions.