Confidence and Money Is a Dangerous Combination

As previously published in The Rich Investor: By John Del Vecchio

Confidence.

It’s an important factor in the markets. And in politics.

The markets can move wildly on changes in confidence. They can become a self-fulfilling prophecy.

Markets are a confidence game. Sometimes the markets are simply a con. It’s not that easy to accumulate wealth in the markets. Markets have a habit of picking your pocket when you’re most complacent.

Politics are much the same way. Politicians are among the best con artists in society. When they win the confidence of the public, they can control all the power.

Today, there’s lots of confidence out there in the general public.

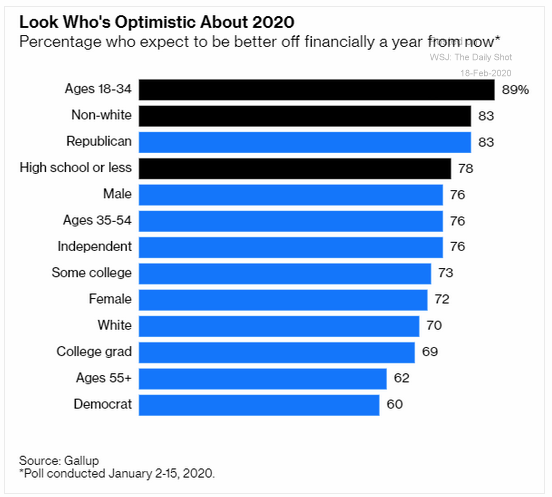

Take a look at this.

Young people, non-whites, high school educated folks, and republicans are oozing with confidence. That’s why I think if the election were held today, Donald Trump would win the election.

Easily. A landslide. Not even close.

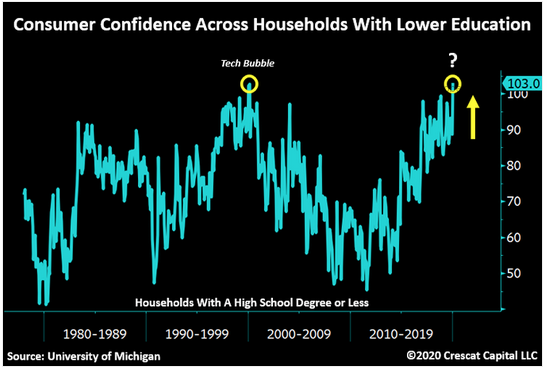

Households with lower educations are super confident. That’s Trump’s core base. Those people are going to come out and vote. Of course, the last time they were this confident, it was as the technology bubble was peaking.

We know what happened from there. It got ugly. Trillions of dollars lost in thin air. Few people fully recovered.

In addition to folks without a college degree, I think Donald Trump is going to get much more of the African American vote than a traditional Republican would. I think he’ll get much more of that vote than any poll will suggest.

As a result, he’s going to blow away his Democratic opponent. If Trump gets 15% of the African American vote, it’s over. No need to wait until midnight to get the election results.

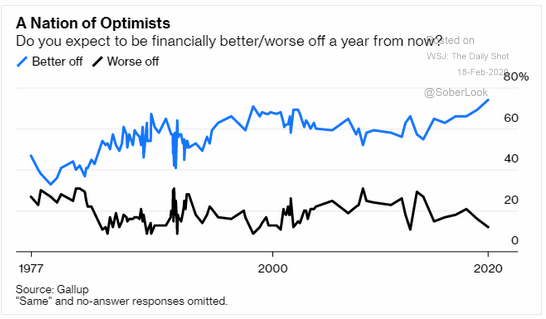

Confidence is nice. But you can have too much of a good thing. As a nation as a whole, we are the most confident in decades.

And that scares the shit out of me.

In my new book, Unbounded Wealth, I talk about the George Costanza school of investing.

In a nutshell, you do the opposite of what everyone else is doing. Just like the character George did when he was at his most successful on the show Seinfeld.

The result is that you end up with way more money in your pocket than the average investor. A lot more money.

Right now, I am in full Costanza mode. I have discretionary spending on lock down mode. I’m not investing any big chunks of fresh capital into the markets. Especially not the U.S. markets.

The strategies I use on autopilot are still in place. But, anything outside of that is getting stuffed in the mattresses.

Today reminds me a lot of the last two bubble peaks just before a big ass kicking. Not only did I survive those, but profited handsomely from them.

With so many people so confident, I am terrified. Besides my colleague, Harry Dent, most economists don’t see this because they don’t live in the real world. Pay attention to what people in all walks of life are doing and saying, and you’ll get your finger on the pulse of the economy.

When the market bottomed out in 2009, I was in need of a car. While everyone was scared to death, I was able to score an incredible deal on a car. I was the only person at the dealership! They looked at me like I was a green alien. Someone was there to buy a car?!?

That’s when the good deals are had. Not in times like today.

Tread carefully.

In the meantime, learn about the Costanza strategy and more steps to break free of “The Man” in Unbounded Wealth. It’s free to order today. You just pay a small shipping fee. Take the first step and take control over your own life. Your brokerage account will thank you for it.