Déjà vu All Over Again

By Brad Lamensdorf and John Del Vecchio

It’s Déjà vu all over again!

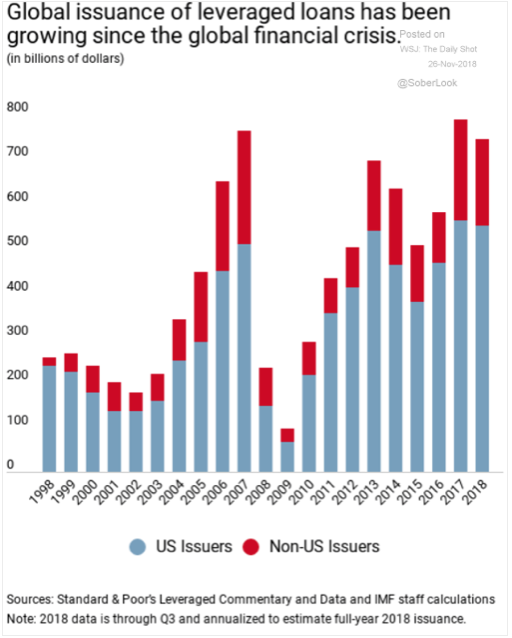

Levered loans are back! Ever since the global financial meltdown, levered loans have been on the rise. Loan issuance is now near the highs of the last peak.

Before the market imploded.

This is a serious warning sign not to be ignored. Why? Because leveraged loans are a type of loan extended to companies or individuals that already have considerable debt. Or, these borrowers have a poor credit history.

Leveraged loans carry a higher risk to the investor. As an indicator, this chart also should help visualize that we are in a very heated environment and that has allowed debt to pile up. The tipping point is unknown. But, the other side will be particularly ugly.

In a word…default. Lots of them.

Recent data released also showed that 80% of borrowers who refinanced in the third quarter chose the cash out option and was the highest since the start of 2007.

So, more and more people are pulling cash out of their house to fund their lifestyle. In a normalized environment, economic activity wouldn’t benefit from this artificial demand created by increased cash outs.

When this comes to an end, and it will, we will see a slow-down. Defaults will also rise because people are way out over their skis.

We saw this movie before 10 or 12 years ago. It’s a horror movie. It doesn’t end well.