Despite Stock Market Drop, Sentiment Indicators Warn: Don’t Buy!

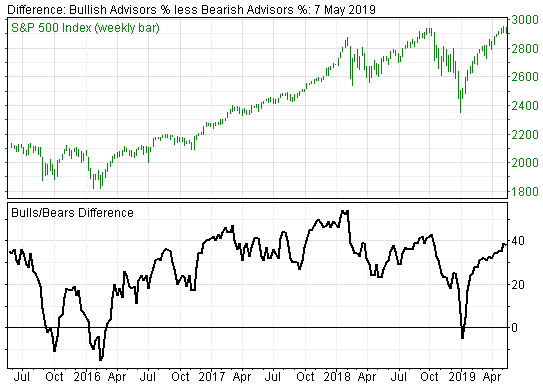

Despite Stock Market Drop, Sentiment Indicators Warn: Don’t Buy! We use investor sentiment as contrarian indicators for determining market direction. The indicators in past weeks have been warning that the stock market would remain highly volatile. This is because investors, who historically are wrong, were overly optimistic. Sure enough, confirming the market’s vulnerability, Trump’s China tariffs triggered this past week’s retreat. So is this a time to buy? Not according to the sentiment indicators.

That’s because despite the downturn, sentiment indicators haven’t moved at all, remaining in overbought territory as investors remain complacent. And seemingly unphased by the drop.

For example, the Investors Intelligence Bulls/Bears poll of stock market newsletter writers shows bulls at 55% and bears at 18% with the spread between the two at 37. That’s virtually unchanged from the previous week. Bullish sentiment at 55% means high risk for investors, and 60% calls for major defensive action.

Meanwhile, the VXX volatility Index at around 25 remains at a multi-year low, indicating investors are very complacent compared to last December at 45 to 50 when it was signaling the market was oversold at about the time of the year-end market drop.

The way professionals play the sentiment indicators is not to be ahead of them, but rather to follow them to wait for the next time the indicators reach extremes indicating it is time to buy or sell. We will continue to monitor sentiment in the coming weeks as important lead indicators.