“Dumb” Money in Control

By John Del Vecchio and Brad Lamensdorf

Last week, we highlighted the TIR indicator as being very oversold and stretched to the downside. We suggested the odds favored a bounce.

Boy did we get one.

Stocks exploded higher. Especially low-quality stocks with a bit of “hair” on them. It was a tough week for short positions.

Even though these indicators have swung around a lot in recent months, major headwinds still exist for stock prices.

One headwind is that “dumb” money is in control.

Take a look…

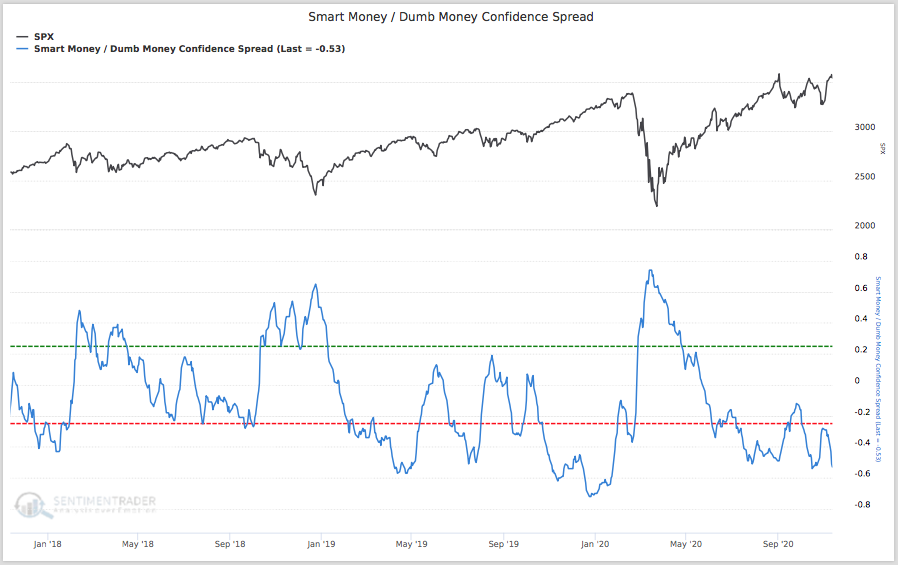

The chart, compliments of SentimenTrader, shows the spread between Smart and Dumb money. It should be ovbvious…we want to follow the smart money. Those investors are in hiding. Smart money investors were very bullish at the lows in March and April. Since then they have retreated.

Now the dumb money is bullish.

What’s more is that dumb money is becoming more and more bullish. The trend is working toward the pre-pandemic levels.

Right before a major ass kicking.

The short-term bounce we expected has occurred. Intermediate-term though, there is a risk all of those gains and then some will be lost.

Making big bets here on higher stock prices is placing a wager on the dumb money.

Did you know that Active Alts has teamed up with SentimenTrader to launch a long / short strategy? To learn more about how these indicators can guide your investments in these uncertain times, schedule a call with Brad here.