Fund Managers Have Blown their Wad

By John Del Vecchio and Brad Lamensdorf

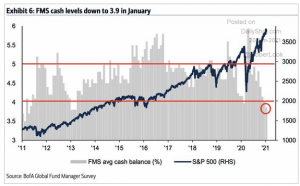

Fund managers have blown their wad of cash. The B of A Global Fund Manager Survey shows that cash levels have dipped below 4%.

This is a contrarian indicator.

Historically, cash levels below 4% indicate little cash on hand while 5% has proven to be too defensive. A 1% difference may not seem like much. But we are talking about trillions of dollars here.

As the chart clearly shows, high cash levels typically coincide with some very tradeable bottoms since 2011.

Back when the market was falling apart as the COVID pandemic hit, fund managers raised cash well above the upper band of 5%.

Since then, the market has gone virtually straight up.

This creates a couple of problems for fund managers. One is peer pressure. The market is roaring and cash becomes a drag. It becomes a major drag when you have the fastest rebound ever from a bear market like we saw in 2020.

The other problem then becomes performance anxiety.

There’s nothing like some anxiety to cause you to do things you might not normally do. So, fund managers chase risk. Often outside their comfort zone. They may do this against their better judgement.

As a result, when they are chasing stocks that they know they shouldn’t, it becomes a contrary indicator.

They have given into their emotions.

Market bulls still stand over 60%.

This is a warning sign.

Risks are higher here. Many stocks are off to a booming start in 2021. It’s becoming too easy to make money.

Nothing about the markets is easy over time.

Now is the time to prepare hedges.

Where are the landmines ahead?