Intermediate Sentiment Indicators Signaling Market Could Go Lower S&P 500 Below 2600 Is Signal for Market Selloff

Short-term sentiment indicators were of little use earlier this week in signaling market direction, while intermediate-term indicators were signaling the markets were headed lower.

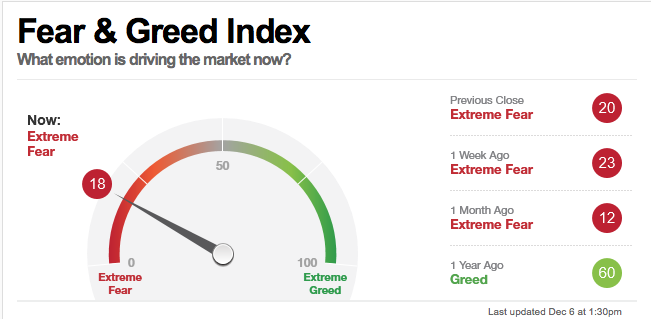

On the short-term side, the CNN Fear/Greed moved to 18, meaning investors were somewhat fearful, which is bullish from a contrarian point of view. However the Ned Davis Research short-term gauge was at 45, which is neutral.

S&P 500 Below 2600 Is Signal for Market Selloff

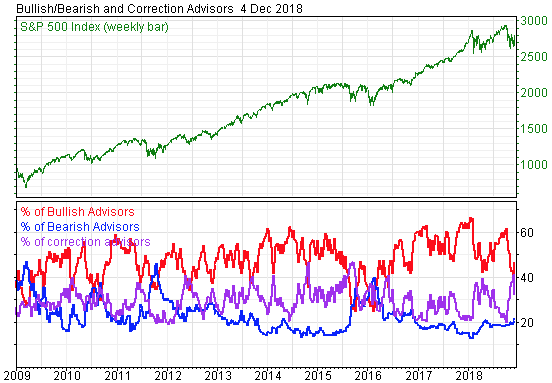

The real action earlier in the week occurred on the intermediate side. Investor sentiment turned more bullish hoping for a market correction based on some positive news on a China trade deal (news that was called into question later in the week). Optimistic investor sentiment is historically a signal the markets are headed lower from a contrarian point of view since investors are usually wrong about market direction. The Investors Intelligence Bulls/Bears poll of market newsletter writers came in at 48% bullish, a 10-point jump, while the bears came in at 21%. Newsletter writers indicating a correction was coming also jumped up a lot (see the purple line in the chart below), another negative from a contrarian point of view. Meanwhile the NDR crowd sentiment indicator bounced to 59 from 51 the previous week.

The market action on Tuesday and again this morning on Thursday has been very unsettling in terms of market direction. Bank stock dropped precipitous, breaching support levels and playing a major role in the market drop. I continue to draw a line in the sand at 2600 on the S&P 500. If violated the market is likely ready for another leg down.

S&P 500 Below 2600 Is Signal for Market Selloff. Chart is courtesy of Investors-Intelligence.