Investor Sentiment Continues to Warn Stock Market is in Danger Zone

Investor Sentiment Continues to Warn Stock Market is in Danger Zone. We use investor sentiment as a contrarian indicator. Although bullish sentiment declined somewhat week over week, bullish sentiment remains in a danger zone. As a result that means historically means investors should be taking defensive moves. This includes at the minimum tight stops and possibly selling some stocks with big gains. In other words, don’t be greedy, or be lulled into complacency by misleading record highs by the major market indexes such as the S&P 500 and the Nasdaq. The fact is those records are essentially reflecting performance by high flyers like Apple and Alphabet, which account for large percentages of the indexes’ performance. They are masking underlying market weakness as reflected in the fact that recently more stocks have declined than gone up.

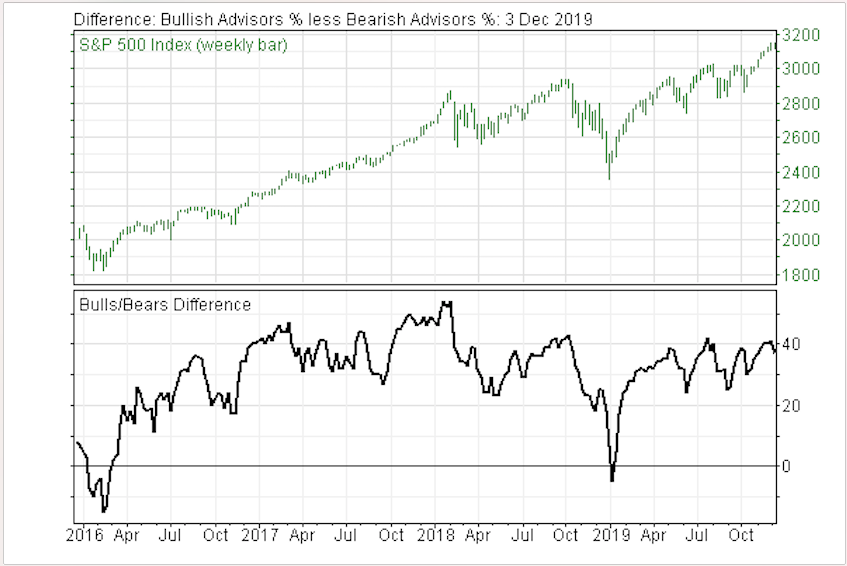

Nevertheless, those major market index records continue to lull unsophisticated investors into a false sense of security. The Investor Intelligence poll of more than 100 newsletter market writers, who historically are wrong, shows bullish sentiment remains high at 54.8%. Although that’s a drop from the previous week’s 58.1%, bullish sentiment this high still means investors should be contemplating defensive moves. Meanwhile, bearish sentiment was basically unchanged, moving slightly higher to 17.3% from 17.1%. The bull-bear spread narrowed to +37.5%, from +41.0% a week ago. Spreads above 30% signal increasing danger the higher they get.