Investor Sentiment Gauges Have Been Suggesting Stock Market Top

Investor Sentiment Gauges Have Been Suggesting Stock Market Top. We use investor sentiment as a contrarian indicator on the direction of the stock market because investors historically are wrong. Along with most of the so-called stock market experts they blindly follow. So, one of our favorite contrarian indicators is the Investors Intelligence Bulls/Bears poll of stock market newsletter editors. Over the last several weeks we reported that the editors were becoming increasingly bullish. And we pointed out that historically as the editors become increasingly bullish that triggers increasingly loud warning bells to start get your defensive ducks in order.

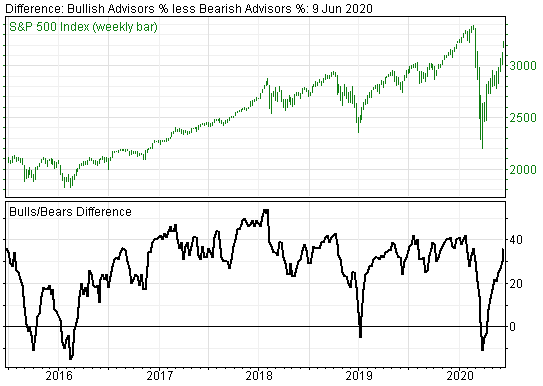

This week the Bulls/Bears indicator moved into danger levels. We never quite know when the market will turn following a buildup of such increasingly alarming warnings. But they should be heeded, as the big market plunge proved this week.

As you can see from the chart below, the spread between the bulls and the bears increased alarmingly this week as the bulls were ever more optimistic despite signs over the last few weeks that the market had become very overbought. The difference between bulls and bears jumped to +36.3%, from +29.8% a week ago. That is the widest positive spread since mid-January, and just above the level prior to the late February market plunge. Like lemmings mindlessly nearing a cliff, the recent market surge moved the bulls up to 56.9%from 53.5% a week ago. At the same time, bearish sentiment fell to 20.6% down from 23.7 in the prior week.

Another warning sign from the poll was that only 22.5% of the writers expected a correction. So, what’s the lessons here? Go with the historically accurate indicators. Don’t become blindingly greedy. Ignore the ignorant herd mentality leading you and your wealth over the cliff.