Investor Sentiment Has been Signaling Stock Market at Precarious Levels

We use investor sentiment as a contrarian indicator of where the market is headed. So, Investors earlier this week were getting increasingly optimistic about the market despite clear signs that stocks were becoming very overpriced. The more stocks become overpriced, the more they are subject to falling down for any number of reasons, including unforeseen events.. That’s something like a house built precariously on stilts in a danger zone. Will it be wind, fire an earthquake or a hurricane? Or maybe a mudslide? . All we know is something could easily knock the stilts from under it.

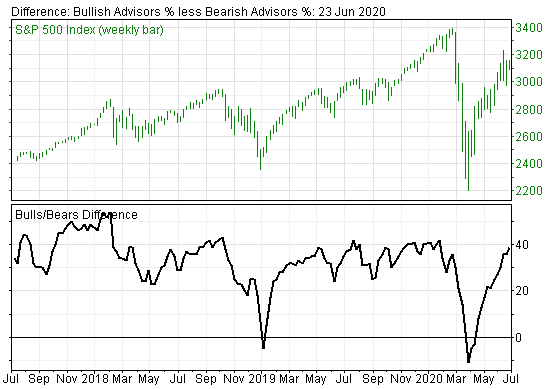

As stocks rebounded early in the week, the Investor Intelligence poll of editors of stock market newsletters showed the editors were becoming very bullish. So, it is no surprise that later in the week, the market took a big hit amid renewed coronavirus fears. Bullish sentiment among the writers increased to 57.3% from 54.9%. That’s a level that historically tells investors they should be prepared for a market slide. Bearish sentiment at 18.4% also meant investors should be careful.

Meanwhile, the bull-bear difference jumped to +38.9% from 36.3% (See chart below). That’s the widest spread since mid-January when it hit +41.5%. That’s also an increased call for caution. In other words: Be careful out there!