Investor Sentiment Indicators Advise Greater Caution

Investor Sentiment Indicators Advise Greater Caution. We use sentiment as contrarian indicators on stock market direction. Bullish sentiment was up among the more than 100 newsletters polled by Investors Intelligence. It reached a lofty 58% compared to 56.7% the week before. That is the third straight week this indicator has been in the danger zone of 55% and above. Now moving closer to 60% which historically indicates extreme danger. The elevated risk means investors should take defensive positions.

Another warning sign is that bearish sentiment in this poll fell to 16.8% from 18.3% a week ago. For contrarians fewer bears in the poll means higher risk since most of these writers and editors are fully or nearly exposed to stocks. That means limited funds for further buying. A final note of caution in this poll comes from the spread between bullish and bearish sentiment, which expanded to +41.2% from 38.4% the week before. A spread above 40% also calls for defensive action.

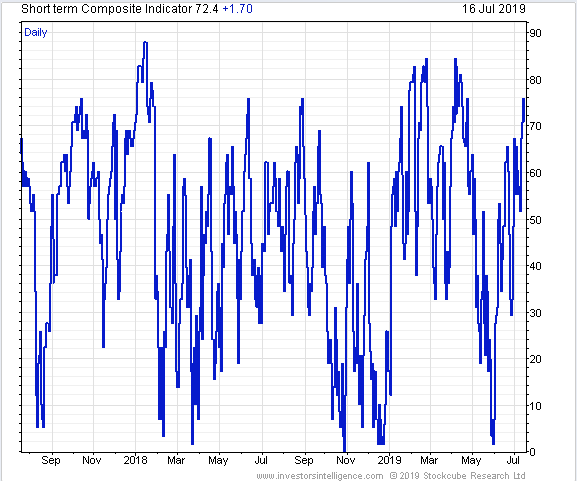

Meanwhile, the short-term composite indicator was up 1.70 to 72.4 (see chart), adding another note of caution for investors that the market is becoming overheated.

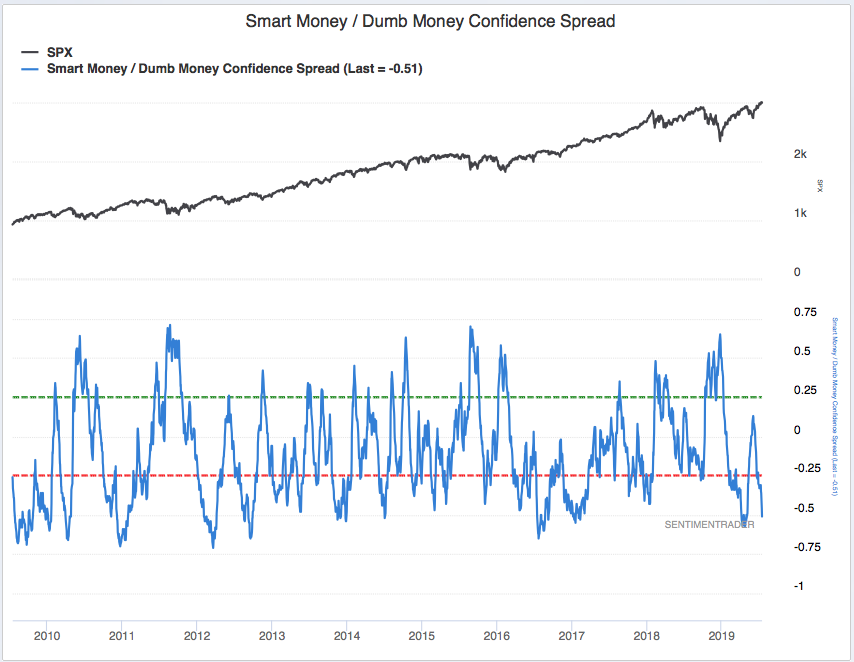

Finally, the Smart Money/Dumb Confidence Spread, derived from monitoring trades from historically good and bad investors, also was telling investors to beware, dropping to -0.51 (see chart).