Investor Sentiment Indicators Continue to Warn Investors to Lighten Portfolios

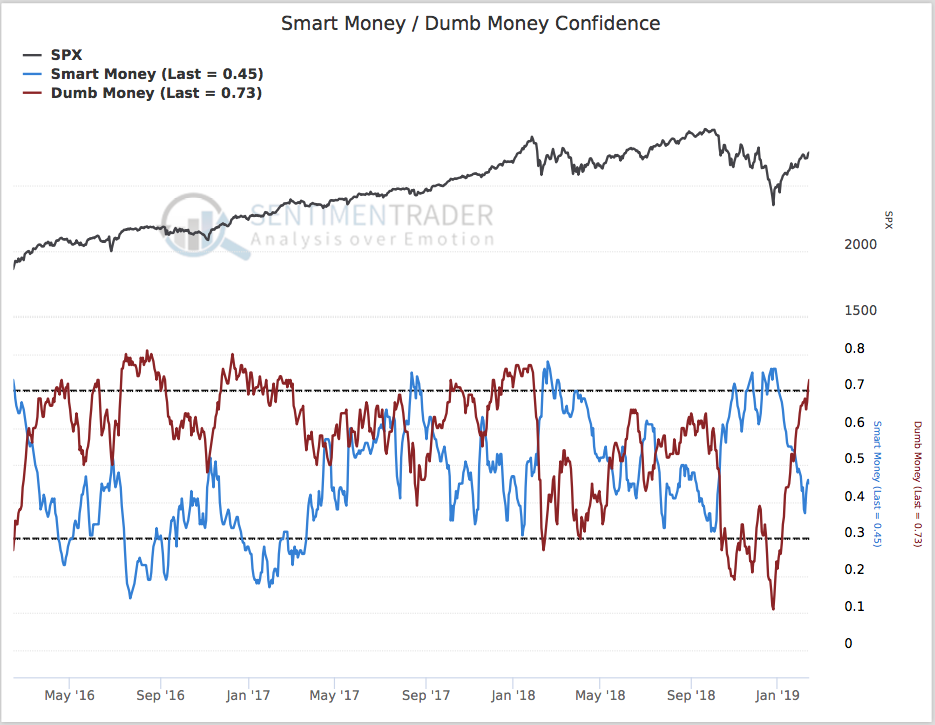

Investor Sentiment Indicators Continue to Warn Investors to Lighten Portfolios. SentimenTrader’s Smart Money Confidence and Dumb Money Confidence indices allow investors to follow what “good” market timers are doing with their money. This as compared with what “bad” market timers are doing. What’s happening now? The chart below shows that the smart money is becoming less confident, while the dumb money is becoming more confident. That’s a clear warning sign that investors should take defensive action. It is important to note that dumb-money confidence was very low. Smart-money confidence in the market was very high just before the December bounce. That change in confidence in such a short period of time also illustrates how volatile and dangerous the markets have become.

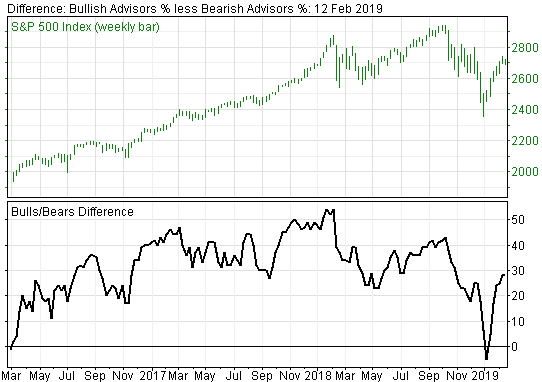

Meanwhile, the CNN Fear/Greed short-term sentiment indicator climbed to 67 even further into greedy territory from 62 the week before, and from 13 a month ago. That’s a negative from a contrarian point of view. Intermediate term indicators have also become more negative. For instance, the Investors intelligence Bulls/Bears poll of market writer sentiment came in at 21% bears and almost 50% bulls. That’s a positive spread of 29, compared to December when the spread was a negative 5 just as the market bounced and the bears outnumbered bulls.