Investor Sentiment on Stock Market is Moving from Bullish Toward Cautious Signals

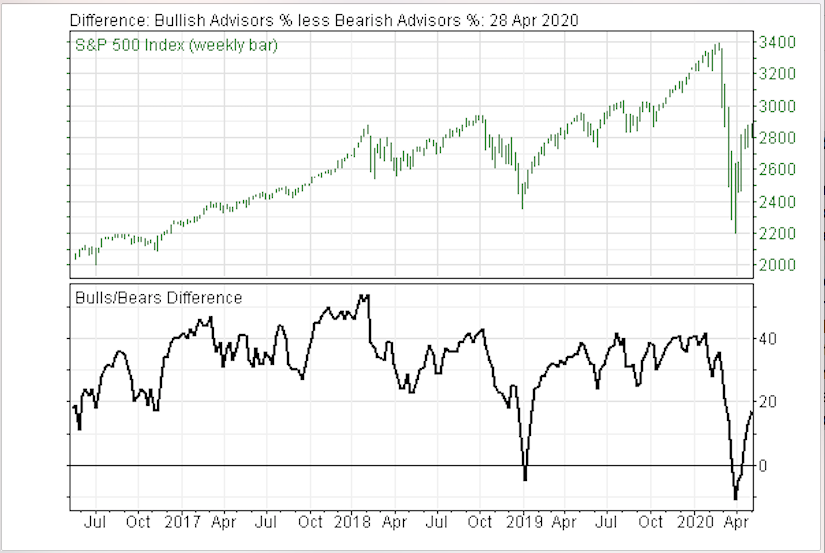

Investor Sentiment on Stock Market is Moving from Bullish Toward Cautious Signals. We use investor sentiment as contrarians indicators on the direction of the stock market. One of our favorite contrarian indicators is the Investor Intelligence poll of more than 100 newsletter editors. Historically they are no better at playing the stock market than the average investor. In other words, they usually get it wrong. During the past week bullish sentiment increased to 46.6% from 43.39%. Bearish sentiment slipped to 29.1% from 30.8% as more editors concluded the bear market was over. That is astounding in light of all the damage the pandemic is doing, including causing historic drops in the GDP. In fact, there is so much uncertainty about the future that 90% of the S&P 500 reporting companies have withdrawn forecasts on future financial results. Nevertheless, the spread between the bulls and bears increased to 17.5% from 12.5% (see chart).

Taken as a whole, the increased level of optimism is a signal that investors should be increasingly watchful about the true direction of the market as sentiment signals move from more bullish levels and the spreads widen toward levels that signal caution. It is important to remember that in late March the Investor Intelligence poll showed bears clearly outnumbering bulls with a negative spread of -11.6%. Negative spreads as they widen historically are strong bullish signals for the market from a contrarian viewpoint. And sure, enough the market since then moved up sharply, and with it bullish sentiment has been increasing while bearish sentiment is declining. And that means there’s far less certainty that the market is headed for another big upward move. The higher the spread, the more it is signaling market risk, particularly at +30% and higher. In fact, spreads over +40% and higher historically signal investors should take defensive measures.