Investor Sentiment Suggests Stock Market Nearing Danger Zone

Investor Sentiment Suggests Stock Market Nearing Danger Zone

We use investor sentiment as a contrarian indicator of the direction of the stock market. An increase in bullish sentiment during the past week suggests the stock market is entering a danger zone, at least for the short term. The Investor Intelligence Bulls/Bears poll of market newsletter writers and editors shows bullish sentiment during this week increasing from 52.8% last week to 54.2%. Bullish sentiment over 50% indicates investors should be cautious. A 55% level and above means investors should start taking defensive action. Meanwhile, bearish sentiment in this poll was pretty much unchanged at 17.8%. Anything below 20% means investors should not be thinking about a significant buying program.

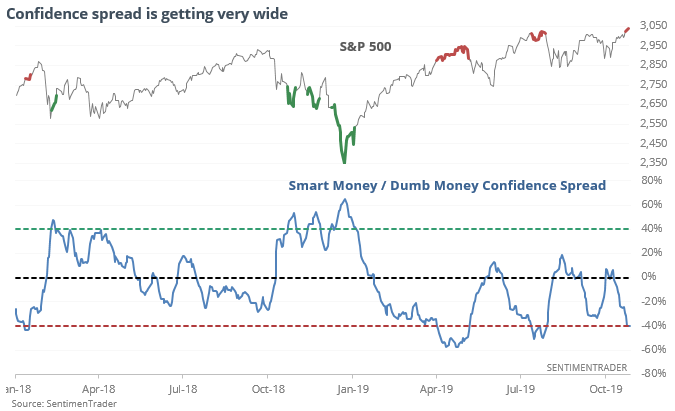

Another note of caution in the poll from a contrarian viewpoint is that is that the number of market newsletter “gurus” expecting a correction decreased to 28.0% from 29.3%. Moreover, the spread between bullish and bearish sentiment expanded for the third week, to +36.4% from 34.9% a week ago (see chart). Differences as they rise above 30% call for increasing caution. Spreads above 40%, which occurred in late July, call for defensive measures.

Another spread signaling increasing danger comes from SentimenTraders smart/money dumb money indicator which shows the spread widening between the actions of smart and dumb traders falling into the -.40% danger zone (see chart).

Our conclusion? Remain cautious.