Investors Beware: Surging Bullish Sentiment Signaling Stock Market is in Dangerous Territory for Short and Medium Terms

Surging Bullish Sentiment Signaling Stock Market is in Dangerous Territory. We use stock market sentiment as contrarian indicators of where the market is headed. So we’ve been watching with growing concern the steady climb of bullish sentiment during the last few weeks towards levels that historically occur before short-term and intermediate-term downturns. For instance, trading of calls has been outpacing puts at a rate that historically has signaled a short-term downturn (see chart below). The put/call ratio recently was 0.65.

Chart from: SentimenTrader.com

Investors Beware

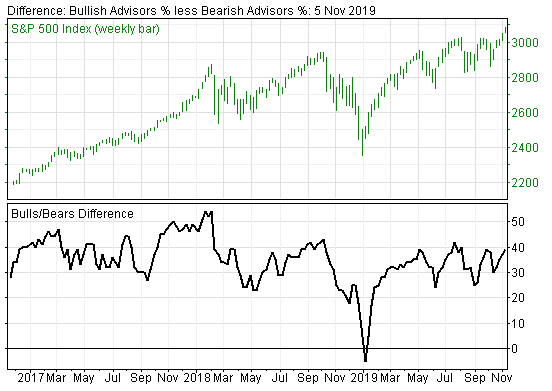

Meanwhile, things are looking equally bleak for the intermediate term as evidenced by climbing bullish sentiment from the Investor Intelligence poll of stock market newsletter writers/editors. During the past week bullish sentiment advanced to 57.1% from 54.2% the previous week, compared to October when bullish sentiment had fallen to 47.6%. To put this in perspective, bullish sentiment above 50% calls for caution. Bullish sentiment above 55% means investors should start taking defensive measures, including implementing tight stops and some selling of shares with large gains. It is important to note that bullish sentiment peaked to 58% in July followed by the sharp August selloff. We should note even more dangerous are the rare times when bullish sentiment climbs above 60% bulls. That last time that occurred was in Jan 2018, just before a major selloff.

Meanwhile, bearish sentiment was at 18.1, only slightly up from the previous two weeks. Bearishness below 20% is not generally attractive for broad buying. Meanwhile, for the fourth week the bull-bear spread expanded (see chart), ending at +39.0%, from +36.4% a week ago, compared with +30.4% at the start of October. Spreads moving above +30% call for increasing caution. Bull-bear spreads above+40%, such as occurred late in Late July before the August downturn, again call for defensive measures.

Sentiment Chart

Copyright 2019 by Stockcube Research Ltd.www.investors-intelegence.com.