Is It Finally Time for Value Stocks?

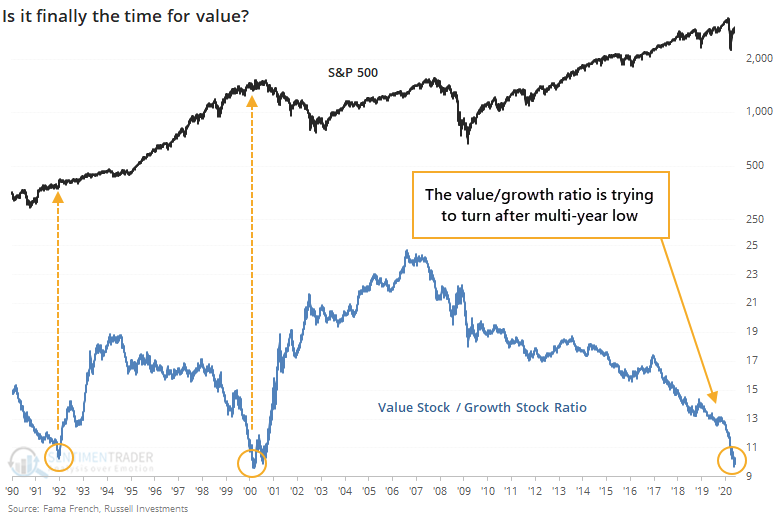

Is It Finally Time for Value Stocks? In the summer of 1979, a BusinessWeek cover story pronounced “The Death of Equities.” Three years later in 1982 the stock market hit bottom and then rocketed higher. Since then the total return on the S&P 500 index with dividends reinvested has been more than 7,000%. This legendary wrongheaded call on stocks comes to mind because some so-called market commentators have been saying value stock investing is dead. It is true that growth stocks have outpaced value stocks for years, as shown by the value/growth ratio in the chart below. But it also is true that the shift in market leadership between growth and value stocks runs in cycles, and when the shift happens it happens very fast.

Dimensional Fund Advisors in a recent study says that it is not the performance of value stocks (about 12.9% annualized) that has been historically out of whack, but that return on growth stocks has been abnormally high –at about 16.3 percent over the past 10 years. That compares with a 9.7 percent return since July 1926. So, what could turn the cycle around? For one thing, market values tend to eventually return to norms. So, there’s the possibility that a market downturn might negatively affect growth stocks more than solid value stocks because of the growth stocks’ elevated p/es. There’s also the possibility of Increased interest rates spurred by inflation. That could make many investors less willing to pay the high price-to-earnings multiples that growth stocks command in today’s low interest rate environment. There’s also the fact that value stocks tend to do better in an economy recovering from a recession. To be clear, we’re not saying the cycle is about to reverse, but given the long term ratio of growth over value, this is an area worth watching. Particularly when the market gurus begin to tell you to forget historical cycles, this time it will be different.