It’s No Surprise Stock Market Analysts Have Been Upgrading Price Forecasts At just the Wrong Time

It’s No Surprise Stock Market Analysts Have Been Upgrading Price Forecasts At just the Wrong Time. In our view, many Wall street analysts are about as reliable at forecasting stock prices and market direction as fortune tellers who use smoke, mirrors, and crystal balls to summon your long-dead great aunt. In fact, they are wrong so often that they are a fairly reliable contrarian indicator on market direction (see chart and tables below). That’s why it is no surprise to us that Wall Street experienced another giant hiccup this week in the midst of analysts upgrading price forecasts. Why no surprise? The analysts were

upgrading despite warning signs based on historically-proven statistics we use that the market was climbing toward dangerously high price levels. To put this into perspective, we’ve been saying for weeks that the market was becoming very overbought based on very reliable indicators. That includes Warren Buffet’s favorite: Comparing total market capitalization to the GDP, which was at one of its most dangerous levels ever. We also talked about the S&P 500 relative stock industry being the most overbought In history.

It was this kind reliable, unemotional statistical analysis we were using to tell you the market had become oversold in March when stocks collapsed spurred by the corona virus panic . And what were the wizards of Wall Street doing amid clear signs of a bottom? They were panicking because they’d been caught off guard at the peak. Rather than being caught off guard again, they were following emotion. So, they were downgrading price forecasts at an historic rate when the statistics were saying otherwise. This all begs the question about whey are the analysts so wrong, so often. The obvious answer, of course, is they don’t follow the historically-proven statistics. Truth is these high-paid, so-called experts who should know better fall into the same emotional frenzies that make investor sentiment a highly reliable contrarian indicator. So, they also are subject to something we call FEMO, “the fear of missing out.” Another to the mistaken belief that to disregard history because “this time things are different”

Now, the wall Street gurus will defend themselves by saying they couldn’t have predicted the coronavirus, just as they were caught off guard in the past by other events. That’s subject to another debate. Reality is that the statistics we use, and they too often ignore, are important indications on the health of the market. In this way, you don’t have to know exactly what will cause the next downturn, or upsurge. However, what the statistics are telling you is that when stock prices are historically too high, for instance, you should be prepared for unforeseen events that could pull the rug out from under it. And this time is never different.

Analysts are chasing the trend… again

Published on June 23, 2020 by Troy Bombardia

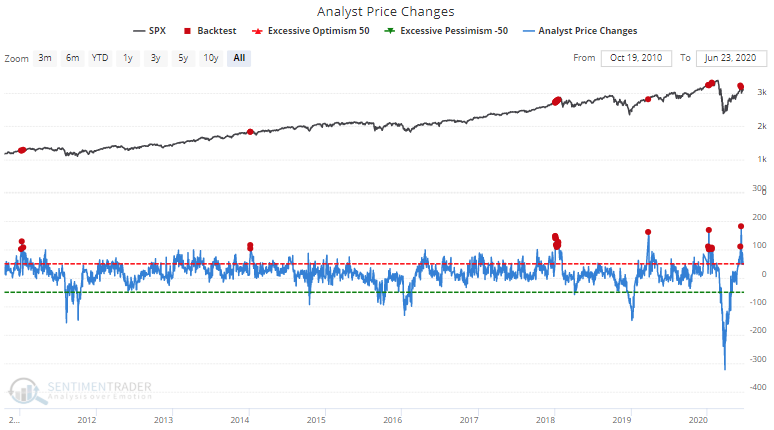

Analysts were aggressively upgrading their price targets for S&P 500 stocks almost 2 weeks ago as the U.S. stock market (and tech stocks in particular) surged. Keep in mind that back in March, analysts were downgrading their price targets at the fastest clip ever as they bet on the end of the world.

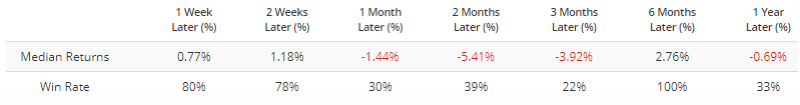

The following contrarian signal looks at the net number of S&P 500 stocks for which Wall Street analysts have upgraded their price target (# of upgrades – # of downgrades).