Leverage Works Until It Doesn’t

By John Del Vecchio and Brad Lamensdorf

Investors are levered. Up to their eyeballs.

Leverage works until it doesn’t.

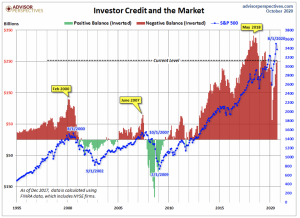

Take a look at this chart below, courtesy of Advisor Perspectives.

Investors have taken on more and more leverage as the market has climbed higher. Negative balances are not quite to the levels of May, 2018 but they do dwarf the levels of February 2000 ad June 2007. That’s right before a major beatdown in the market.

Notice, investors had the highest positive balance in February 2009 about a month before the bottom and a generational buying opportunity.

Once again, the masses are asses. Over and over again we can easily see herd mentality at work. Combined with rich valuations and too much exuberance among the “dumb money” crowd, the market is setting itself up for disappointment in the intermediate-term.

As we pointed out in the September 29 Chart of the Week, the market was due for a bounce after tech leaders took it on the chin last month. That bounce occurred.

Many stocks rallied sharply. But don’t blink as now they are starting to fade rapidly. Worse they are coming down on heavy volume. There is real selling in these stocks.

With too many people leaning in one direction, especially with leverage, it makes the pain of a move to normalcy that much worse.

How should you prepare for the future?

Why don’t you give Brad a call and get his market insight personally? Brad’s Active Alts SentimenTrader Long/Short Strategy combines several decades of experience and research and actively positions the portfolio to take maximum advantage of market extremes. In both directions.

Book a call on Brad’s calendar here.