Major Indicators Show Global Economy is Weakening.

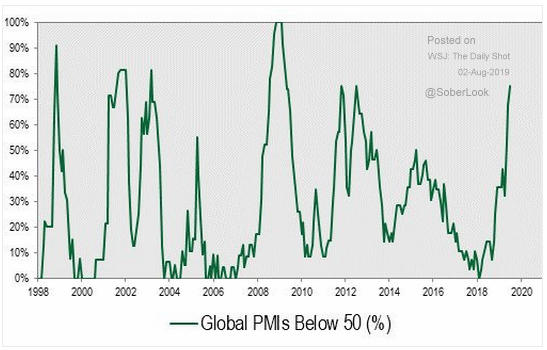

Major Indicators Show Global Economy is Weakening. A growing number of countries are experiencing slowdowns in manufacturing. According to the Purchasing Manufacturing Index (PMI), a survey of prevailing economic marketing trends that is a major tool for corporate decision makers. The chart below shows tremendous growth in the number of countries with a PMI below 50, which indicates their manufacturing is contracting. Some like Germany, whose faltering PMI we highlighted in the previous Chart of the Week, may already be in recession.

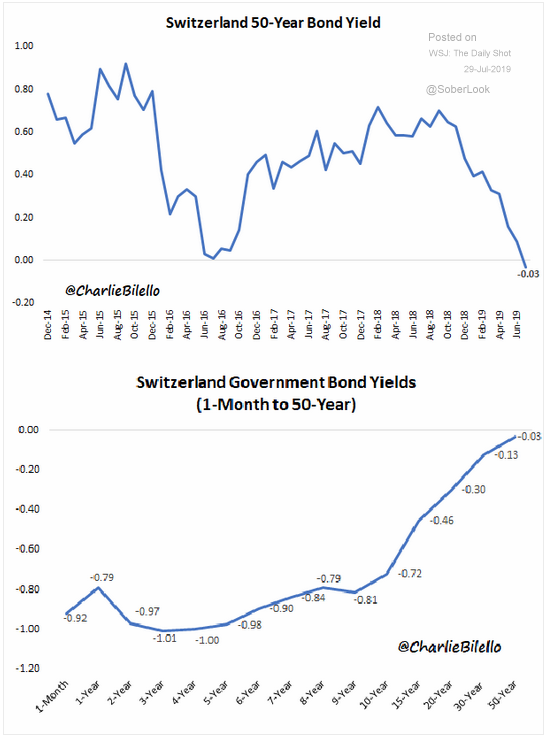

Meanwhile, another indicator of an economic slowdown is that the amount of global negative yielding debt grew this week to a record $14.1 trillion, compared with $12.5 trillion a month ago (see June 27 Chart of the Week). A rush into negative yielding bonds historically occurs right before and during economic bad times as investors seek protection in the safest debt. Examples such as Swiss debt (see chart below) even if it means negative appreciation.

We’re highlighting these signs of a weakening global economy because investors shouldn’t be lulled into complacency because the U.S. economy is doing somewhat better. What happens there eventually boomerangs here. We are all tied together in the global marketplace.

Here is the percentage of the world’s economies with contracting manufacturing sectors (PMI < 50).