Margin of Safety? What Margin of Safety?

By John Del Vecchio and Brad Lamensdorf

Back in the 1990s, if you were in Economics 101 at university and suggested that interest rates would be zero or negative (particularly when there was full employment), you would have received a big, fat “F” on your report card.

That’s where we are.

As the chart from Bloomberg shows, global debt yielding negative rates has exploded. The chart just as quickly could be the stock price of the latest money-losing, cash-burning, initial public offering.

It is out of control.

Of course, the trend is your friend until the end when it bends. This trend could continue. Negative rates could indeed be the new normal.

However, when markets move this far from normalcy, they are vulnerable to nasty corrections. Typically, people are surprised. We know from the current market sentiment that the masses are leaning in a historically bullish direction.

The market could push up rates. Rates could go up for reasons we don’t even expect. Firstly, we could have a currency crisis. It does not even have to be a key currency. Back in 1997 and 1998, the Asian Crisis started with the Thai Bhat. Secondly, it could be war. Recent times have been relatively peaceful. A significant conflict could cause disruption. Thirdly, a new U.S. administration and its policies could throw a wrench in the works and disrupt the credit markets.

Low rates have pushed stocks up to new highs.

New highs do not mean more risk. Again though, we are not in normal times.

Low interest rates have distorted the markets.

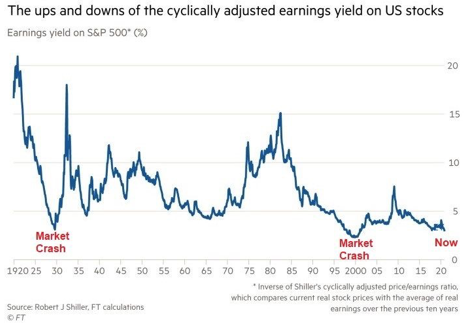

Going back a century, the cyclically adjusted earnings yield on stocks sits around where it was before two brutal market crashes.

Is this time different?

Possibly.

It also means that the margin of safety is razor-thin right here right now. We are only a few months from the COVID lows, but we are a long way from the markets’ lower risk position back then.

The Active Alts SentimenTrader Master Key was defensive going into 2020. Then, near the lows, it turned very bullish. It’s not signaling something historic.

The Master Key unlocks the mystery of how to position yourself in the market. The Master Key has been developed based on decades of experience as well as world-class research from SentimenTrader.

Book a call with Brad to discuss how to position your portfolio coming into 2021 and beyond.