Money for Nothing but the Risks are Not Free

By John Del Vecchio and Brad Lamensdorf

The masses are at it again!

As the market climbs higher, investors are borrowing more and more on margin to pad their gains.

Greed is in full force.

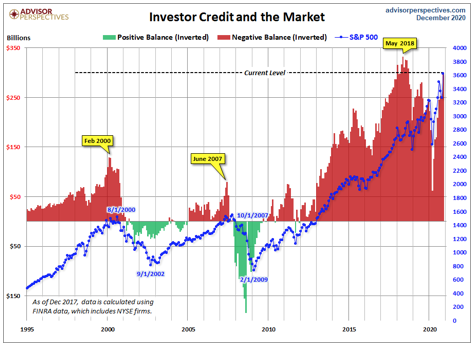

Take a look at this chart, courtesy of Advisor Perspectives, that shows investor credit balances since 1995.

Negative balances are not yet to new highs, but they are close and surging.

In the past, there have been peaks in negative balances right before a significant ass-kicking in the market. That is why we watch sentiment so closely.

First, the period of February 2000 shows a peak. Then stocks imploded. Second, a peak formed in June 2007. Then a butt-kicking ensued. Third, the mother of all peaks formed in May of 2018. By Christmas, the markets were a massacre. Lastly, just before COVID hit, negative balances were creeping up again.

So, here we are near new highs in both the markets and margin. The risk is that as investors unwind these positions when they flinch, the market plummets faster and harder.

A swift decline will create significant opportunities to snap up great stocks at low risk.

We saw this opportunity in early 2020. The Active Alts SentimenTrader Long / Short strategy was positioned conservatively heading into 2020, jumped into stocks near the lows and rode that trend for the rest of the year.

Want to better position your portfolio for 2021 and beyond? Book a call with Brad to discuss how the Active Alts SentimenTrader indicators can help your performance and manage your risk.