Not-too-Hot, Not-too-Cold Investor Sentiment on Stock Market Suggests Further Upside

Not-too-Hot, Not-too-Cold Investor Sentiment on Stock Market Suggests Further Upside. We use investor sentiment as a contrarian indicator for where the stock market is headed. The Investors Intelligence poll of more than 100 market newsletter writers is an important contrarian indicator for the direction of the stock market. These writers tend to act like sheep with a wrong-headed herd mentality that defies reason. They are inevitably frightened and extremely bearish at market bottoms when they should be buying. Additionally, they are extremely bullish at market tops when they should be taking defensive positions. We use this to our advantage. So right now, tepidly bullish and bearish sentiment suggests the market probably will be going higher. Here’s why.

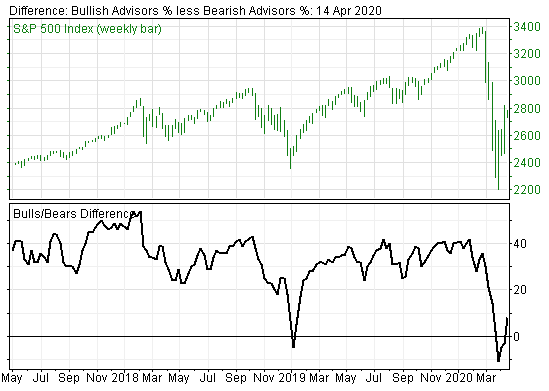

Bullish sentiment during the past week jumped to 40.9% from 33.3% last week but remained far lower than the 55% bullish level that signals defensive measures. At the same time, the market’s rebound propelled bearish sentiment lower to 32.4% from the previous 36.2%. Bearish sentiment levels below 20%, which occurred for most of 2019, usually are not attractive for buying.

Meanwhile, as the chart below illustrates the spread between bullish and bearish sentiment moved to +8.5%, ending three prior negative readings in a row when the bears outnumbered the bulls. Those negative spreads, which historically are signals to buy, once again proved to be accurate bullish indicators by signaling the latest market rally. So, what of the present +8.5% spread? That spread remains in buy territory but not as strong a buy signal as when the spreads were negative. In the opposite direction, spreads above +30% signal increasing concerns the higher they get, with defensive measures appropriate above 40%.spreads. So, what does all mean? The rapid changes in investor sentiment coinciding with the market advances and retreats suggests the markets will remain very volatile and not for action by the faint of heart until there is very clear direction.

Sentiment Chart