Profits? We Don’t Need No Stinkin’ Profits!

By John Del Vecchio and Brad Lamensdorf

The stock market remains on fire. We have been bullish on the market at times this year. Especially during the major low after the COVID fallout and a couple of other times when stocks became too oversold.

The more this rally runs though, the riskier it gets. We are now in full pause mode.

One of the most worrisome factors is the quality of the rally recently.

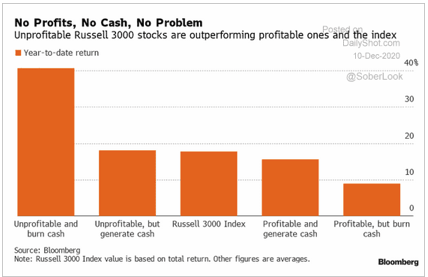

The less profit a company makes and the more cash it burns, the better is does.

Take a look at this chart:

Stocks losing money and burning cash are up over 40% year to date. Meanwhile, profitable, cash generating companies are under-performing the Russell 3000 benchmark.

We know from our own testing that while maoney losing, cash burning companies can have periods of big runs, it’s not a sustainable are of the market for investment.

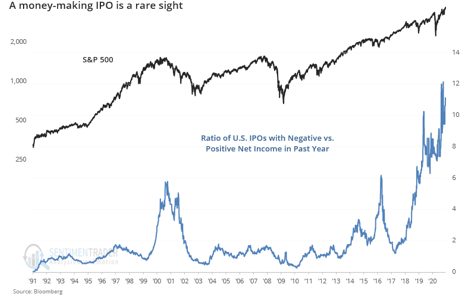

The trend is also concerning when looking at new offerings.

The ratio of IPOs with negative versus positive income is exploding. The current situation blows away the Internet Bubble.

A low quality rally.

Money-losing IPOs on fire.

Market sentiment through the roof.

Bears completely in hibernation.

Valuations are pricey.

While the trend higher can certainly continue, we are more and more skeptical that these gains will be sustained. When these factors swing back the other way, the losses are likely to be very ugly.

Want to protect your capital or even profit when these market factors swing back around? Give Brad a call to discuss how to position your portfolio based on his proprietary research developed over decades.