Snapback Rally About to Hit a Wall

By John Del Vecchio and Brad Lamensdorf

Well, that was fast.

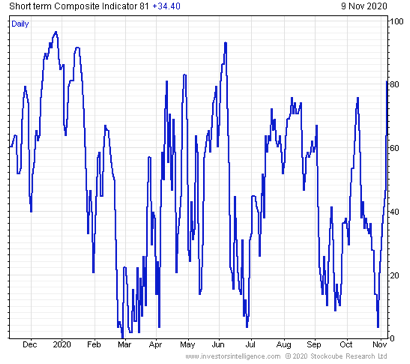

Last week, we highlighted the Investors Intelligence TIR Indicator. This measure of dozens of technical factors was pressed down to a level of three out of 100. The market was seriously oversold.

We expected a big bounce.

That bounce came and it came quickly. It was ferocious.

Just as quickly as the market was extremely oversold, it has come back up and around and is now very overbought.

Take a look at the TIR here. It hit 81 on November 9, 2020.

Markets are a lot like physics. When energy is stored up, the reaction can be significant. That’s what we see when prices get very depressed. Like a rubber band pulled far in one direction, energy is stored up. When that energy is released the snapback is fast and hard.

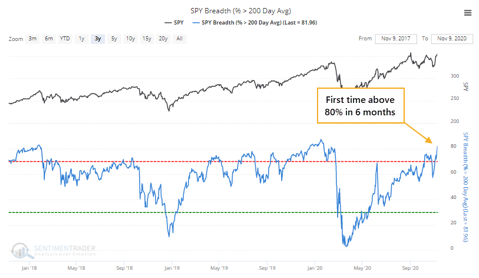

Now that a big move has happened, there’s not as much energy stored up. This is highlighted in the chart below.

The percent of stocks in the S&P 500 that are above the 200-day moving average just hit 80. That’s the first time in 6 months that stocks have been this stretched to the upside.

That percentage is threatening to break a several-year high.

However, there is less energy stored up at these levels.

This comes at a time when market sentiment is getting more and more greedy. The bulls just hit 60%. The bears stand at 19%. The spread of 41% is a danger zone.

Importantly, this survey was done before the Pfizer vaccine news. The spread could be even higher next week.

Yet, risk has increased dramatically from just a few days ago.

It’s time to pare back risk. Quickly.

How should you prepare for the future?

Why don’t you give Brad a call? Brad’s Active Alts SentimenTrader Long/Short Strategy combines several decades of experience and research and actively positions the portfolio to take maximum advantage of market extremes. In both directions.