Soaring Bullish Sentiment is Warning Stock Market Could Be In For Rough Times

Soaring Bullish Sentiment is Warning Stock Market Could Be In For Rough Times. We use investor sentiment as a contrarian indicator of where the market is headed because the average investor historically is wrong. So what is worrisome is that this week’s strong stock market gains have driven up investor exuberance to the highest bullish levels since the fall of 2018, according to Investor Intelligence. And that was followed by a deep dive that gave 2018 the worst performance in 10 years. The Investor Intelligence poll of more than 100 newsletters reports that bullish sentiment climbed to 59.4% from 57.0% the week before. That was the highest level since its peak of 60% in September 2018. Bullish sentiment at 60% and higher historically means investors should be preparing for a market decline.

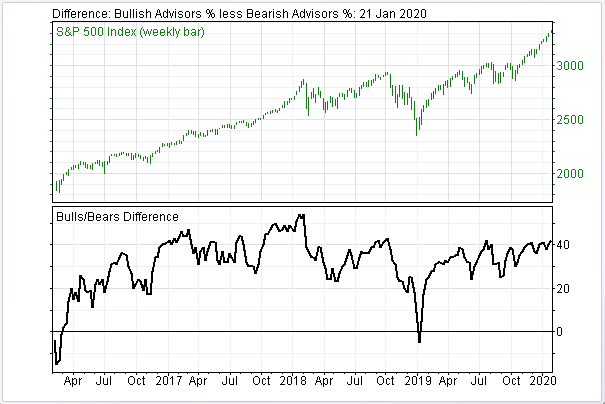

Meanwhile, bearish sentiment was virtually unchanged at 17.9% compared with the previous three weeks’ 17.8%. However, the climb in bullish sentiment pushed the spread between bullish and bearish sentiment into the danger zone at +41.5% from 39.2% the previous week (see chart). Spreads above +40% signal investors should be taking defensive measures. Here’s another warning sign. The latest rally caused another drop in newsletters projecting a correction to 22.7% from 25.2% and 27.1% for the previous two weeks. That’s the lowest percentage of editors projecting a correction since September 2018 when the level briefly fell below 20%.