Stock Market Investment Advisors are Betting The Store With Client Money: Watch Out!

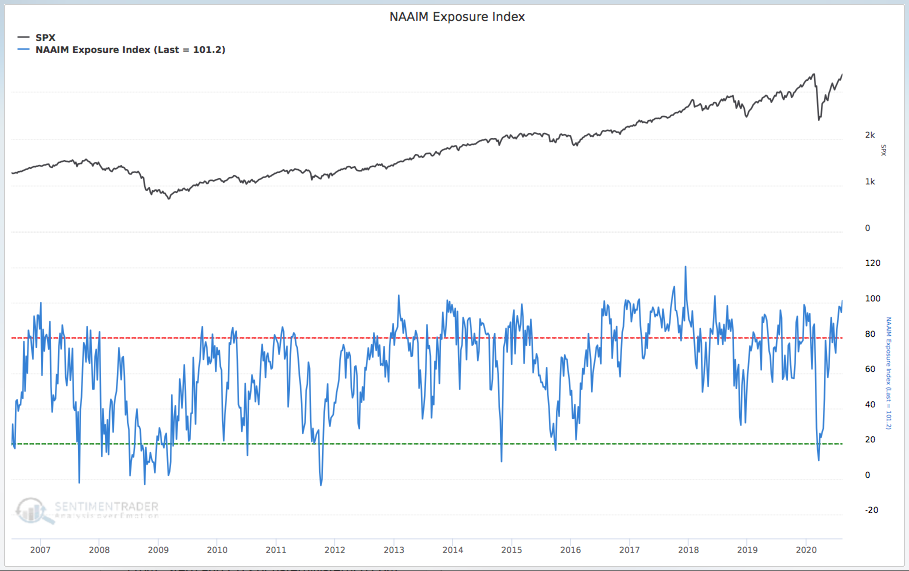

Stock Market Investment Advisors are Betting The Store With Client Money: Watch Out! We use a number of investor sentiment gauges as contrarian indicators for guidance on where the stock market may be headed. That’s because most investors, including the so-called professionals, historically are wrong. One of the indicators we use is the NAAIM Exposure Index from the National Association of Active Investment Managers. The Index represents the average exposure to US Equity markets by NAAIM members who choose to participate in this weekly survey. As you can see from the chart below, the latest NAAIM exposure index is at 101.2. That’s a 20-year high. And that rings all sorts of alarm bells because there’s obviously tremendous irrationality among these managers. They’ve fully committed investor funds to the stock market despite today’s economic pandemic-driven uncertainties. Why have the managers become so irrational? Remember most managers are incapable of beating the stock market indexes. So, as they’ve done in the past, they have blindly thrown caution to the wind for Fear of Missing Out (FOMO). This index also is among a number of gauges we’ve been following that indicate investors in general have become fully committed to the market. Which means there’s a growing lack of liquidity to keep driving the stock market higher and higher.