Stock Market Sentiment Gauges Continue to Flash Warning Signals

Stock Market Sentiment Gauges Continue to Flash Warning Signals. We use a variety of investor sentiment gauges as contrarian indicators to help us determine the stock market’s direction because most investors are historically wrong. As we’ve been reporting for a number of weeks, these historically accurate indicators overwhelmingly have been sending up warning signals for investors to take defensive measures.

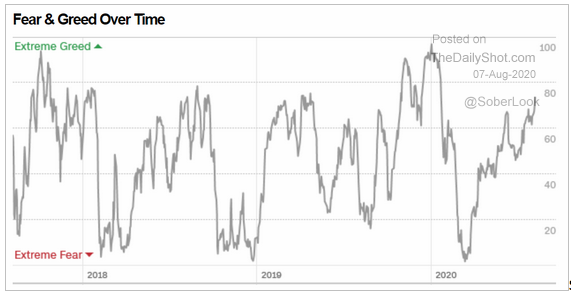

This week we are focusing on both the CNN fear/Greed Indicator and the Put/Call ratios. As you can see from the chart below the CNN Fear/Greed ratio is signaling investors are operating on emotion, exhibiting enormous irrational greed despite the obvious economic dangers. Why is this happening? Once again, we use the term FOMO (Fear of Missing Out) to explain this irrational behavior. Put another way, many investors are betting “all in” although all the warning signs are telling them they should fold to keep their chips to play another day.

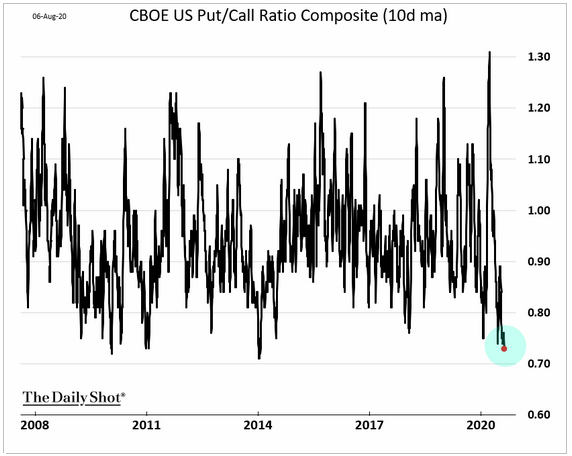

Meanwhile, the chart below on the Put/Call ratio is very low, also indicating the stock market is in dangerous territory. This indicator is one of the most reliable contrarian indicators of future market direction because option buyers are wrong most of the time. The low ratio is telling us investors have become very bullish and have thrown caution to the wind by not hedging against a downturn. The ratio calculates the total number of put options that small traders bought versus the number of speculative call options they bought. The lower the ratio, the less hedging and more naked speculating that they’re doing. In fact, the ratio continues to hedge at its lowest level since the fall of 2007 prior to the financial crisis that decimate the stock market.

The continuing warning signals from these sentiment gauges should not be taken lightly. Particularly now when we have no ideas how long and how deep the pandemic will continue to decimate the U.S. economy.

CNN’s Fear/Greed index is moving deeper into greed territory.

The Put/Call ratio continues to signal rising risk appetite.