Stock Market Sentiment Indicates Investors Should Be Cautious

Stock Market Sentiment Indicates Investors Should Be Cautious. Sentiment Indicators are basically unchanged from a week ago, continuing to indicate that stock market investors should remain cautious. The CNN Fear/Greed at 60 is slightly bullish, which is a negative from a contrarian point of view. Ned Davis Research short-term sentiment at 50 is on the negative side but not as extremely negative as the week before when it was 72.

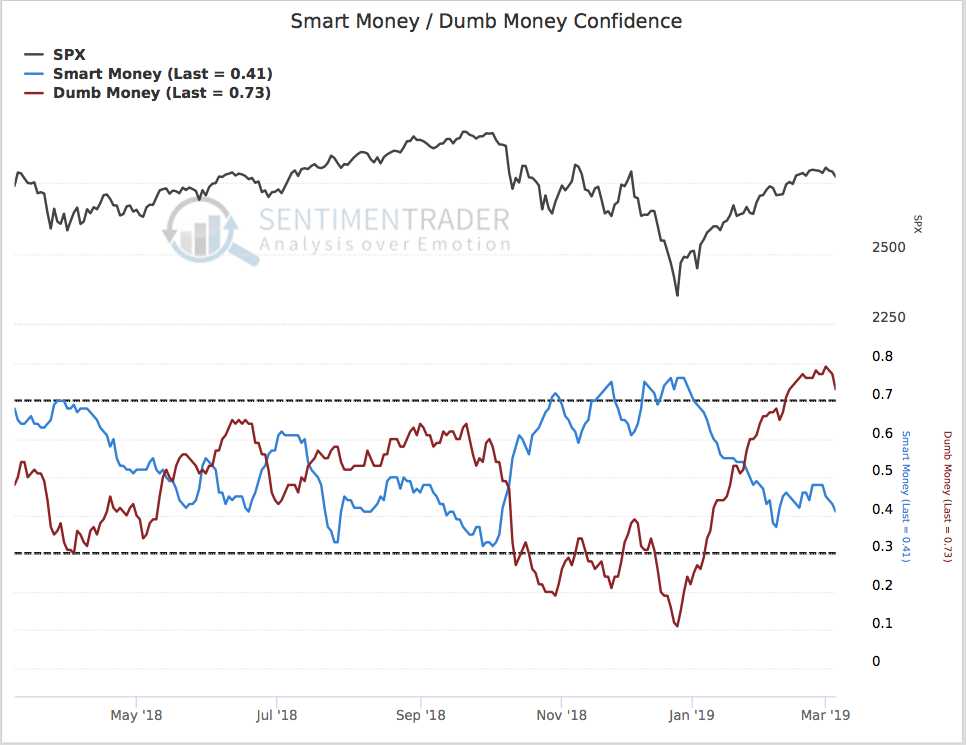

Intermediate term sentiment is also unchanged from last week. The Smart Money/ Dumb Money indicator from www.Sentimentrader.com remains bearish. The Investors Intelligence Bulls/Bears, a poll of sentiment of market newsletter writers, also indicted investors should remain cautious. The poll, basically unchanged from the week before, indicated 53% of the newsletter writers were bullish and 20% bearish. Another negative from a contrarian point of view.

The market has had a large bounce from the December oversold levels. Sentiment, is not outrageously bullish, but it is somewhat overly bullish, which means investors should remain cautious.

Another warning sign that there’s more downside risk than potential upside gain for investors is that bank stocks, which had a big bounce from the beginning of the year, have started to retreat in heavy volume. The KRE ETF, which can be viewed as a proxy for the big banks’ shares, has been headed down in heavy volume.

More warning signs: Stock analysts are downgrading their 2019 earnings estimates, while the OECD has been downgrading estimates for world growth.

Our conclusion: Stay cautious. There’s too much downside risk.