Stock Market Sentiment Indicators Say It’s Still Not Time to Buy

Stock Market Sentiment Indicators Say It’s Still Not Time to Buy. We use investor sentiment as contrarian indicators of when the stock market is oversold and overbought. Because investors are historically wrong about when to buy and when to sell. The recent stock market correction has moved the indicators down from very bullish sentiment levels at market peak. This is not enough into bearish territory to indicate the market has become oversold. In other words, wait before you buy.

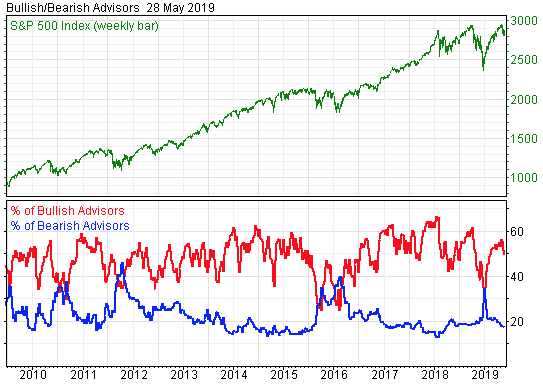

The Investors Intelligence Bulls/bears poll of sentiment among stock market newsletter writers is a good example of what the sentiment indicators are telling us (see chart below). Writers expressing bullish sentiment have gone down from 57% to 49%. But historically from a contrarian viewpoint that’s not nearly enough of a drop to indicate stocks have become oversold.

An even greater note of caution is the fact that bearish sentiment among these writers has not budged. Bearish sentiment is remaining below 18%. Typically at market bottoms, such as in 2016 and 2018, bearish sentiment among these writers has climbed considerably higher at the same time bullish sentiment has dropped much lower. In other words, as the chart indicates, it is going to take a big move upward in bearish sentiment and a greater decline in bullish sentiment to establish a firm market bottom that signals it is a good time to buy stocks.

Chart provided by investors-intelligence.com.