Shifting tides in the ETF Market?

Shifting tides in the ETF Market? The following commentary and Charts are from our friend Kevin Duffy of Bearing Asset Management, LLC.

Morningstar just released active vs. passive fund flows data for January. There was a remarkable turnaround:

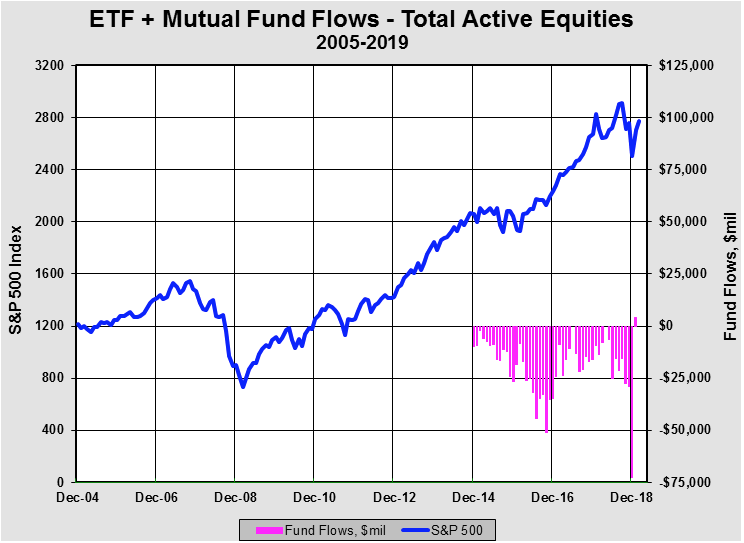

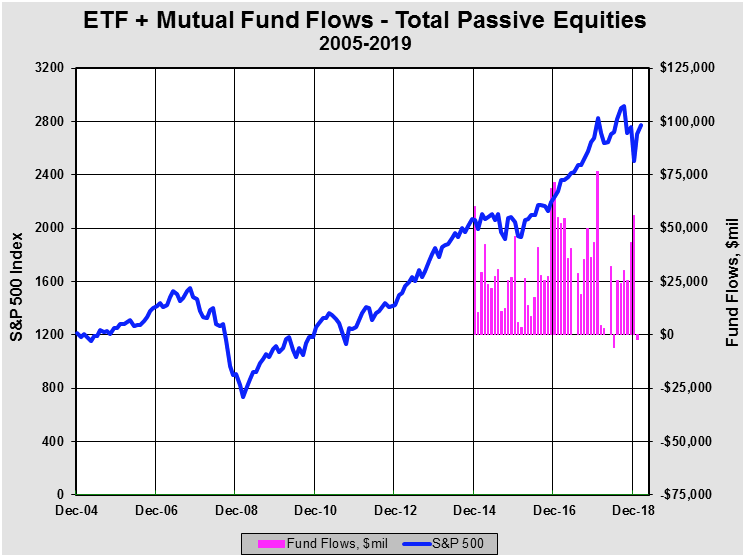

Whether or not this is the start of a trend, it’s worth keeping an eye on. I believe Dec-18 marked a capitulation of sorts out of active investing ($72.6B outflows) into passive investing ($55.8B inflows). The stars now appear aligned for a long run of outperformance by active managers – trillion dollar mega cap tech valuations, financial engineering at large companies, destructive p.c. policies at large companies, a wave of disruption (FAANG companies spent a combined $100B last year on R&D), and changing consumer tastes of millennials. A bear market could also tip the scales.

From the Morningstar report:

January’s biggest surprise may have been the relative flows for active and passive U.S. equity funds. Passive funds fared worse than their active counterparts for the first time since January 2014. U.S. equity funds had modest outflows of $3.8 billion overall, despite the S&P 500 gaining 8% (the index’s best January since 1987). On balance, these outflows came from passive U.S. equity funds, while active flows were flat.

This week’s Chart of the Week comes from our friend Kevin Duffy of Bearing Asset Management, LLC.