The Growth of “Covenant Lite Loans” and Potential Big Risk to the Stock and Bond Markets and the Economy

The Growth of “Covenant Lite Loans” and Potential Big Risk to the Stock and Bond Markets and the Economy. “This will end poorly,” says Anton Pill, managing partner at J.P. Morgan Asset Management. What he was referring to is the tremendous growth (see charts below) of highly risky so-called “covenant lite loans,” which carry hefty interest rates and are used to finance leveraged buyouts and mergers and acquisitions that can have uncertain outcomes. They are also a debt market of last resort for financially troubled companies.

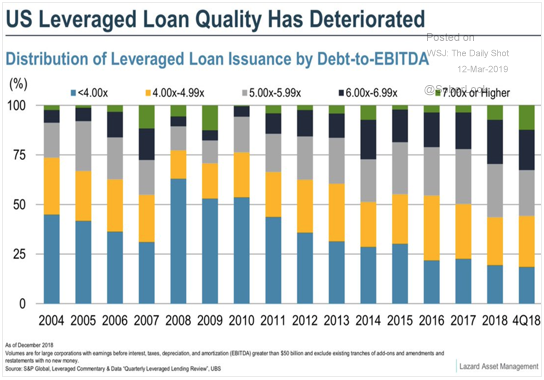

“Covenant lite” means there’s no guaranteed protection for investors who buy these loans(nor early warning) if they default. Moreover, loan quality is hitting record lows when you compare debt to earnings in the form of EBITDA. Recently about 85% or more of leveraged loans were covenant lite. These loans are bundled together as collateralized loan obligations (CLOs) and sold to institutional buyers such as pension funds, as well as retail investors through mutual funds. These investors are taking on big risk for higher returns. Does all this sound familiar? Bank of England Governor Mark Carney sees parallels between the covenant lite market and the subprime mortgage market that led to the 2007 financial crisis. Back then low standard and often fraudulent mortgages were bundled as CLOs and sold to investors seeking outsized returns that turned into no returns. To paraphrase Yogi Berra, “ Is this déjà vu all over again?”