The Hindenburg Omen Issues Rare Sell Signal

By John Del Vecchio and Brad Lamensdorf

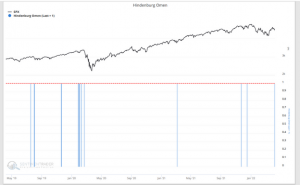

The Hindenburg Omen has issued a sell signal. In recent months, the Omen has indicated lower stock prices ahead. Just prior to the COVID smash, the signal was bearish multiple times.

Here’s how the indicator is designed from SentimenTrader.com:

The Hindenburg Omen is a technical warning sign that was created by James Miekka in the 1990s, based on work from Norman Fosback in the 1970s. It monitors conditions that analysts have looked at throughout history as signifying potential weakness underlying the market. For this particular signal, we use three criteria, which likely differ from other sources: 1) The S&P 500 is above its 50-day moving average, 2) Both new 52-week lows and 52-week highs on the NYSE are greater than 2.8% of all advancing and declining issues, and 3) The NYSE McClellan Oscillator is negative. When the signal triggers, it highlights a “split” market, which is unhealthy. Multiple signals in a cluster is a worrying sign. Traditionally, the signal is canceled after 30 days or if the Oscillator turns positive again, though we’ve seen that it can lead to market trouble several months in advance.

To learn more about how these indicators can help manage risk in your portfolio, book a call with Brad.

DISCLOSURE: LAMENSDORF MARKET TIMING REPORT

Lamensdorf Market Timing Report is a publication intended to give analytical research to the investment community. Lamensdorf Market Timing Report is not rendering investment advice based on investment portfolios and is not registered as an investment advisor in any jurisdiction. Information included in this report is derived from many sources believed to be reliable but no representation is made that it is accurate or complete, or that errors, if discovered, will be corrected. The authors of this report have not audited the financial statements of the companies discussed and do not represent that they are serving as independent public accountants with respect to them. They have not audited the statements and therefore do not express an opinion on them. The authors have also not conducted a thorough review of the financial statements as defined by standards established by the AICPA.

This report is not intended, and shall not constitute, and nothing herein should be construed as, an offer to sell or a solicitation of an offer to buy any securities referred to in this report, or a “buy” or “sell” recommendation. Rather, this research is intended to identify issues portfolio managers should be aware of for them to assess their own opinion of positive or negative potential. The LMTR newsletter is NOT affiliated with any ETF’s. Active Alts is affiliated with Lamensdorf Market Timing Report. While LMTR uses charts from SentimenTrader, they do not have a financial arrangement with SentimenTrader Past performance is not indicative of future results.