The Long-Term Buffet Stock Market Indicator is Flashing Warning Signals

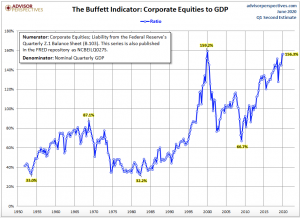

The Long-Term Buffet Stock Market Indicator is Flashing Warning Signals. Comparing the capitalization of the stock market to the GDP is a long-term valuation indicator that is used by many well-regard professionals as part of their decision-making process on how to play the market. In fact, it has been dubbed the “Buffet Indicator” because back in 2001 the “Oracle of Omaha” told Fortune Magazine, “It is probably the best single measure of where valuations stand at any given time.” As you can see from the chart below, the ratio of corporate equities to GDP is 156.3%, up from 156.0% the previous quarter. Which is only surpassed by the ratio of 159.2% in 2000, followed by the two-year dot.com crash through 2002. That sent the market down by about 49% from peak to trough.

Also note the elevated ratio around the time of the financial crisis which caused the S&P 500 to fall 56.4% from 1565.15 to it its low of 682.55 on March 5, 2009. So, it is this ratio and other indicators signaling the market is vastly overvalued that have Buffett and other market sages like hedge fund guru Stanley Drukenmiller so concerned. In a speech to the Economic Club of New York, Drukenmiller recently said: “The risk-reward for equity is maybe as bad as I’ve seen in my career.”

No doubt the stock market is overvalued by many measures, which is historically a setup for a major downturn. But the big question is when? This year? Next year? Remember, the GDP to market capitalization ratio is viewed as a long-term indicator. So, what could the trigger be? Drukenmiller, like many others, is concerned about very serious long-term economic effects of the coronavirus. But then again, there could be mitigating circumstances. Drukenmiller adds: “The wild card here is the Fed can always step up their (asset) purchases.”