The One Metric That Could Trigger a Bear Market

By John Del Vecchio

By John Del Vecchio

Chances are, if you watch the talking heads on TV, they are drooling all over themselves about the Federal Reserve and what actions members plan to take on interest rates. It’s the Fed this and the Fed that.

But, the interest rate that really matters is LIBOR. LIBOR stands for the London Interbank Offered Rate. It’s a really, really important rate.

Here’s why…

When investors borrow money and use their portfolio as collateral, the loan is often priced at LIBOR plus some base interest rate. For example, the loan might be priced at LIBOR plus 1%. Importantly, these loans are not priced on the federal funds rate.

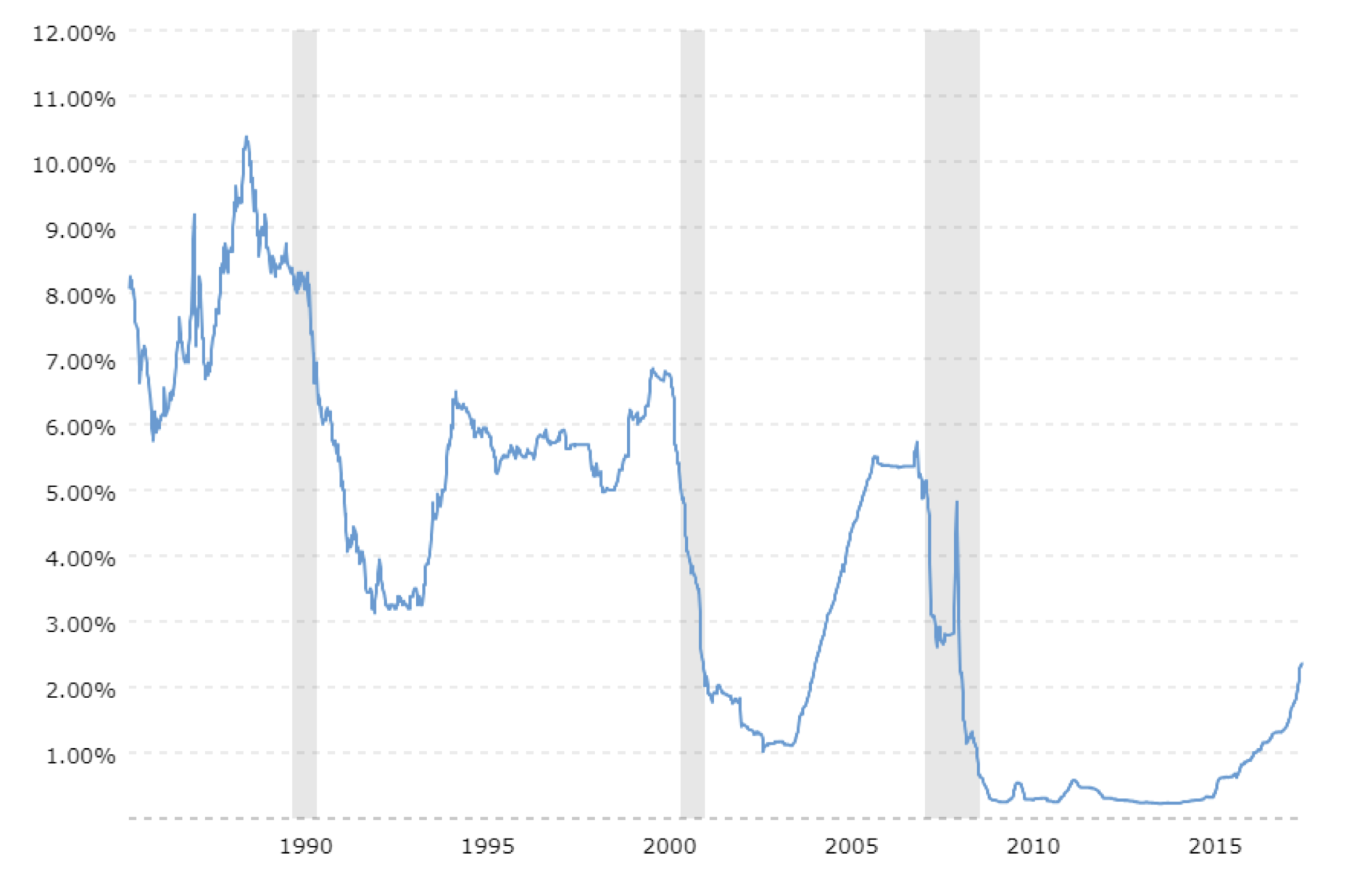

Look at the chart below. The blue line is 3-month LIBOR. Over the past 30 years, LIBOR has trended down. However, recent history tells a much different story.

It’s been rising steadily from the ashes to multi-year highs. Nearly every day it is getting more and more expensive to maintain these lines of credit that wealthy investors have been using.

How much credit is out there borrowed against stock portfolios? Trillions of dollars.

You see, people with portfolios of liquid assets get access to these credit lines. That means people who own stocks. Often you must have more than $1 million in stocks and bonds to get access to LIBOR-plus loans. These are the one percenters.

They can buy a new house or finance a large purchase of an illiquid asset by using their portfolio as collateral. These assets might be boats, planes, fine wine, or investable art.

You name it.

The rub is that the banks don’t ask you what you’re going to use the money for. You just can’t use it to buy more stocks. Anything else is fair game. Want to have a great time in Montreal this weekend? No problem! Just tap into the line of credit. Need to charter private plane for a round of golf at Pebble Beach? The bank will be more than happy to let you tap the line of credit.

The problem is, as interest rates creep up and more portfolios have been used to finance asset purchases, it could create a huge storm if stocks and bonds take even a minor dip. Montreal is fun, but that money has been spent. Hopefully that round of golf wasn’t full of three putts. There’s an old saying that you can always buy a boat but you can’t sell one. And, that’s the problem. Shedding assets when everyone else is feeling pain leads to terrible deals for the seller.

If stock prices slide, the borrower could get margins calls. They have to sell stock. But, they also have to reduce their leverage because they can only borrow so much against the portfolio. Everything unravels at once. This accelerates the selling pressure. What should be down 10% in normal markets might be down 30% in a highly levered market.

Each day, we get closer to the tipping point…