The VXX Volatility Index is Warning of a Stock Market Correction

The VXX Volatility Index is Warning of a Stock Market Correction. We use investor sentiment as a contrarian indicator about stock market direction. VXX Volatility Index , which is a measure of short-term future stock market volatility, is a particularly helpful sentiment indicator, and also is a way to illustrate how more emotional and volatile the stock market has become in the last 18 months. The VXX presently is at a multi-year low, indicating investors have become very complacent.

That’s proved to be an important warning sign of stock market corrections from a contrarian point of view for the past 18 months. Here’s why:

–VXX-related products blew up in February 2018, and the market went from an overbought position into a correction. As a result, investors became very fearful, and the market became oversold as investors headed for the sidelines.

–And that set the stage for the 2018 spring-to-fall rally marked by new market highs, which led to investor complacency despite the fact that the market had become overbought.

–Not surprisingly, that set the stage for last year’s fourth quarter correction, which once again sparked end-of-the world investor fears. Which was a good indicator of an overbought market. Not surprisingly, that was followed by this year’s major rally.

So what’s next? Once again, the VIX is telling us that investors have become extremely complacent, and the market has become overbought. Which once again is a good indicator of a major correction and more volatility than market participants are anticipating at this point.

What are other sentiment indicators telling us? The short-term CNN Fear/Greed index at 62 is in greedy territory but hasn’t change much from the previous week. However, intermediate sentiment indicators have become decidedly more bearish from a contrarian point of view.

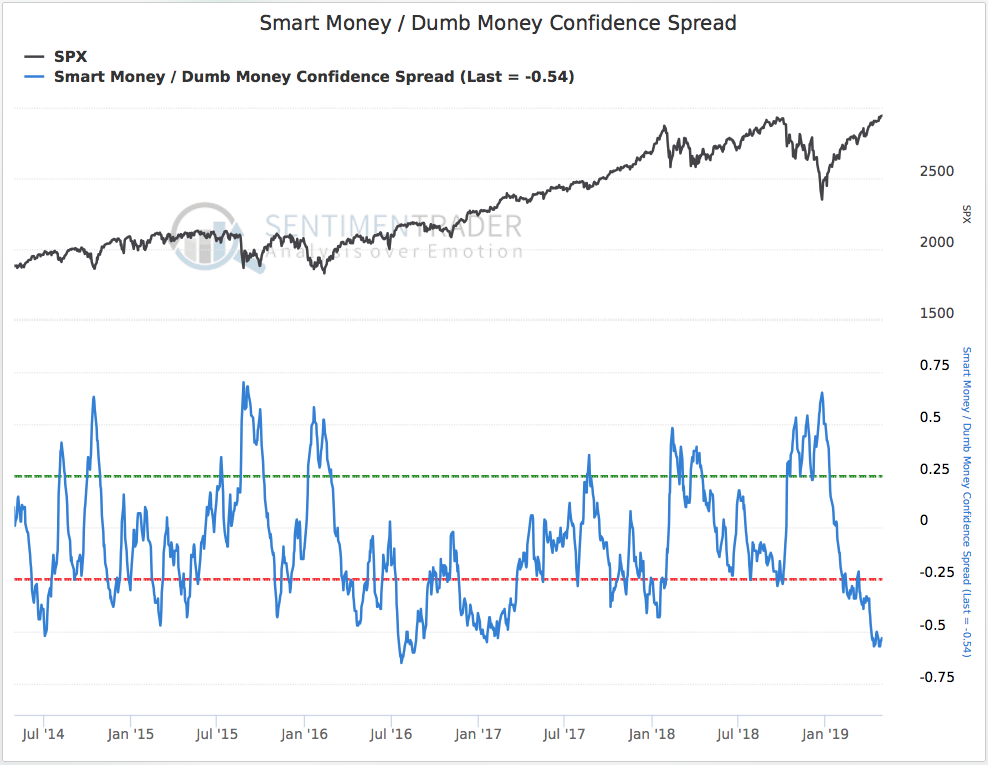

For instance, the Smart Money/Dumb Money confidence gauge has moved to multi year lows showing that the marketplace is getting overly bullish, yet another negative in terms of market direction. Meanwhile, the Investors Intelligence Bulls/Bears poll of stock market newsletter writers shows bulls at over 56% compared with 53% a week ago and bears down to 17%. Bullish sentiment over 55% means higher risk for investors, and 60% calls for major defensive action.