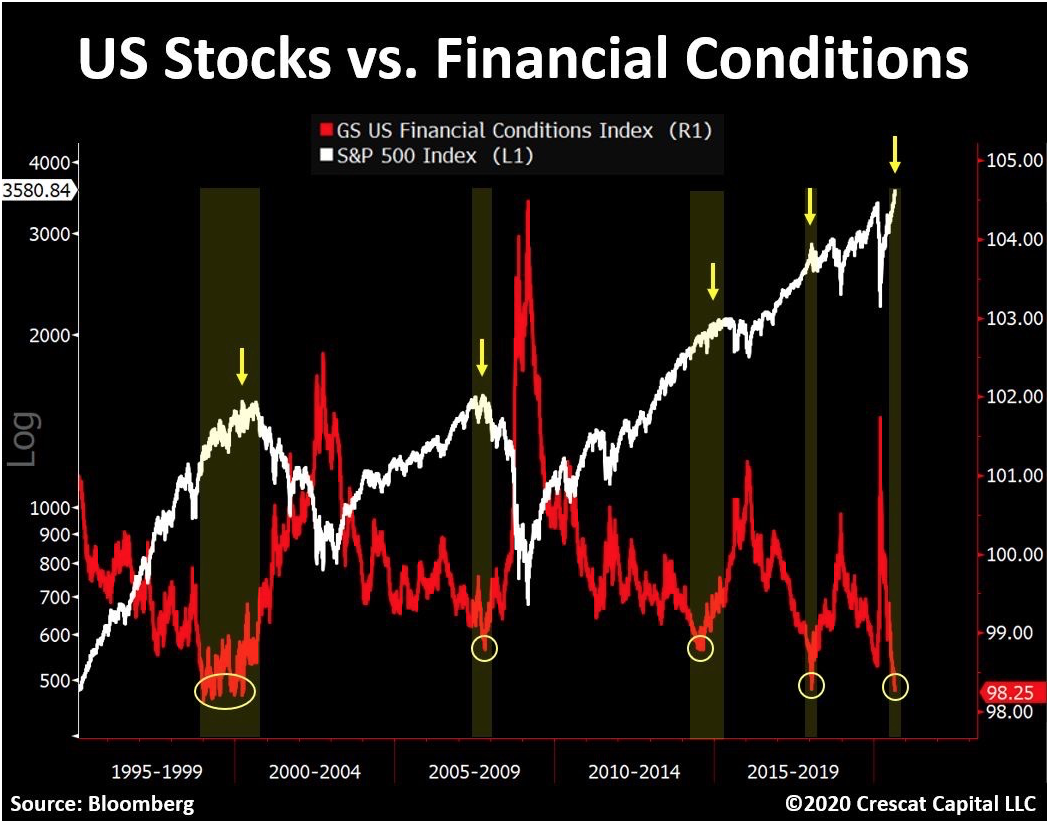

When US Financial Conditions Collapse the Stock, Market Is Sure to Follow

When US Financial Conditions Collapse the Stock, Market Is Sure to Follow. As you can see from the chart below that goes back 30 years, when US financial conditions go down, the stock market inevitably follows. The chart, which was produced before the end-of-the-week downturn, is among many historically accurate indicators we’ve been using that have told us a big market drop has been coming. Although drops can take months after the indicators we use are signaling tops. Nevertheless, those indicators have been signaling us to take profits now and go heavily into cash in our Active Alts SentimenTrader Long/Short strategy.

The reason? Our strategy seeks to minimize risks for longer-term profitability. So, that cash gives us the ammo to short weak stocks during downturns and at the same time keep big reserves to buy stocks near the next bottom. How will we know when the markets have reached near bottom? The same indicators we use to tell us when stocks are overbought tell us when they’ve become oversold. In the chart, you can see the recent major gains by the of S&P 500 index despite the huge drops in the nation’s Financial Conditions Index (FCI). So, history tells us that a sharp stock market drop is all but inevitable. FYI, the FCI was created by Goldman Sachs because older models, such as the effects of short-term interest on the Gross National Product (GDP) have broken down in the last decades as a result of the growing complexities of national and international economics. The FCI is defined as “a weighted average of riskless interest rates, the exchange rate, equity valuations, and credit spreads, with weights that correspond to the direct impact of each variable on GDP.”

Follow