Why Increasing Investor Stock Market Pessimism Doesn’t Mean It is Time to Buy

Why Increasing Investor Stock Market Pessimism Doesn’t Mean It is Time to Buy. We use investor sentiment as contrarian indicators about the direction of the stock market because historically investors are wrong. Although sentiment indicators are showing growing investor pessimism about stocks as an investment, they have not reached historical fear levels that we believe usually indicate the market is oversold and that we’ve hit a firm bottom. In other words, the sentiment indicators are not yet flashing strong buy signals for major buying opportunities.

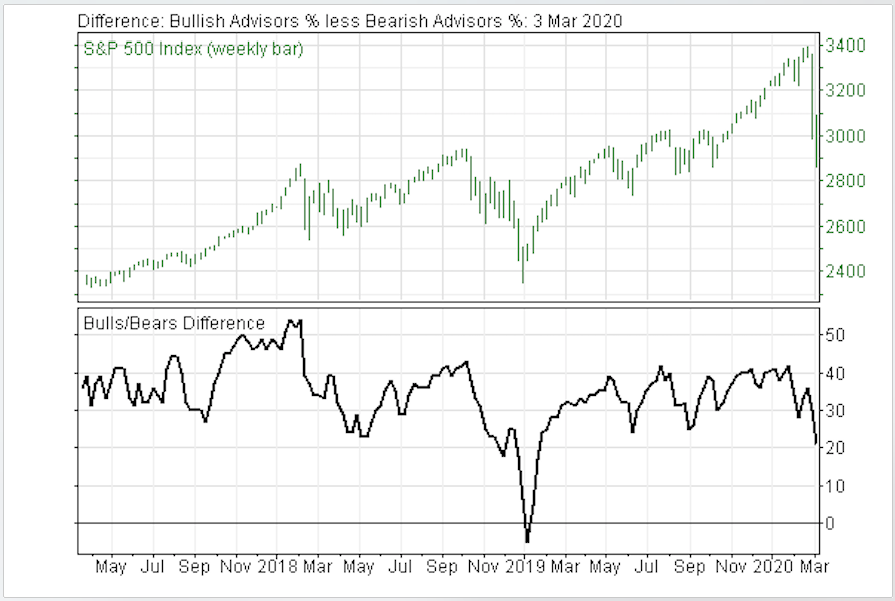

For instance, the Investor Intelligence poll of more than 100 stock market newsletter writers and editors shows bullish sentiment for the intermediate term decreased sharply to 41.7%, from 49.1% and 54.7% the prior two weeks. That’s the lowest level since January, but in our opinion still indicates caution from a contrarian viewpoint. Meanwhile, bearish sentiment among these so-called market prognosticators increased slightly to 20.4% from 19.2% the previous week but hasn’t hit higher levels suggesting major buying opportunities. The spread between bullish and bearish sentiment narrowed to +21.3%, from +29.9 and 35.8% for the previous two weeks (see chart). The lower the spreads go the lower the risk, but the spread at this level we believe still is signaling caution. Negative spreads when there are more bears than bulls, historically point to strong buying opportunities and low risk for longs.

Another important sign of growing pessimism comes from the SentimenTrader Smart Money/Dumb Money Confidence Spread (see chart), which is moving in the right direction. But all in all, the sentiment indicators at these levels, we believe, still call for caution.