Why Our Active Alts SentimenTrader Long/Short Portfolio has Raised Cash

Why Our Active Alts SentimenTrader Long/Short Portfolio has Raised Cash. Many of the tools that we display weekly are actually used in our money management business, www.ActiveAlts.com . We use sentiment gauges of all kinds to help determine risk/reward. Active Alts and SentimenTrader have created an unleveraged long/short strategy called Active Alts SentimenTrader L/S Strategy. The strategy uses SentimenTrader’s world-renown research to help determine the long/short exposure, while Active Alts manages the strategy. We should note that the long/short strategy is 100% powered by SentimenTraders’ research and Active Alts proprietary stock selection. We use SentimenTrader’s compilation of its indicators as a contrarian gauge for market direction to help determine exposure. Based on those indicators, we have raised cash.

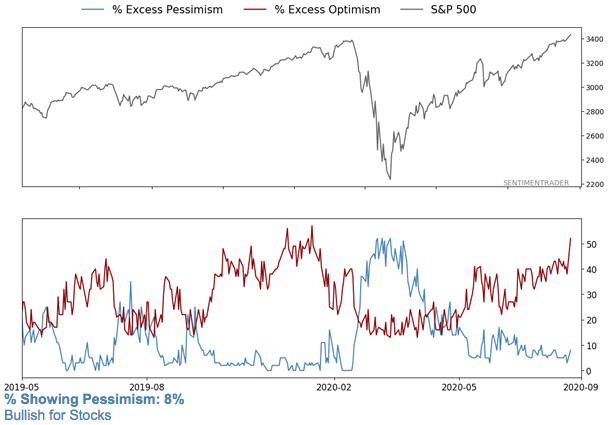

Here’s why! As you can see from the chart below, the compilation of indicators recently has become excessively optimistic. In fact, the percent of indicators showing excessive optimism is now at a very high 52% while indicators showing pessimism have tumbled to a very low 8%. From a contrarian point of view, that excessive optimism and low pessimism is a strong signal for a market reversal since investor sentiment is usually wrong. You’ll note in the chart that the last time these excessive bullish and weak bearish levels occurred was earlier this year just before the Covid-19 pandemic sent the stock market tumbling. There’s no way of determining exactly when a sharp reversal will occur. However, our move to raise cash serves as a hedge against a market tumble. At the same time, the move from stocks to cash preserves strong gains from the recent market upsurge. Moreover, when SentimenTrader indicators signal the next near bottom we will be in a strong cash position to buy low and reap substantial returns as the market moves up.

A bottom.